Retirement Planning in Your 20s

Table of Contents

Retirement might feel far away when you’re in your 20s. You might be more concerned with paying off your credit card or dealing with student loans at this stage, and you could be correct in doing so.

However, the reality is that even a small contribution towards your pension fund puts you ahead of the posse, It’s never too soon to begin planning for your future and setting aside money for your retirement, even in your 20s.

Saving for your retirement now and putting away small proportionate amounts of money while you’re young will make it easier to reach your retirement savings goals over time thanks to the power of compounding and investment growth. This doesn’t mean you can’t achieve more immediate goals such as buying a home or saving for an up and coming big day, week, or month in your life.

When is the best time to start a Pension?

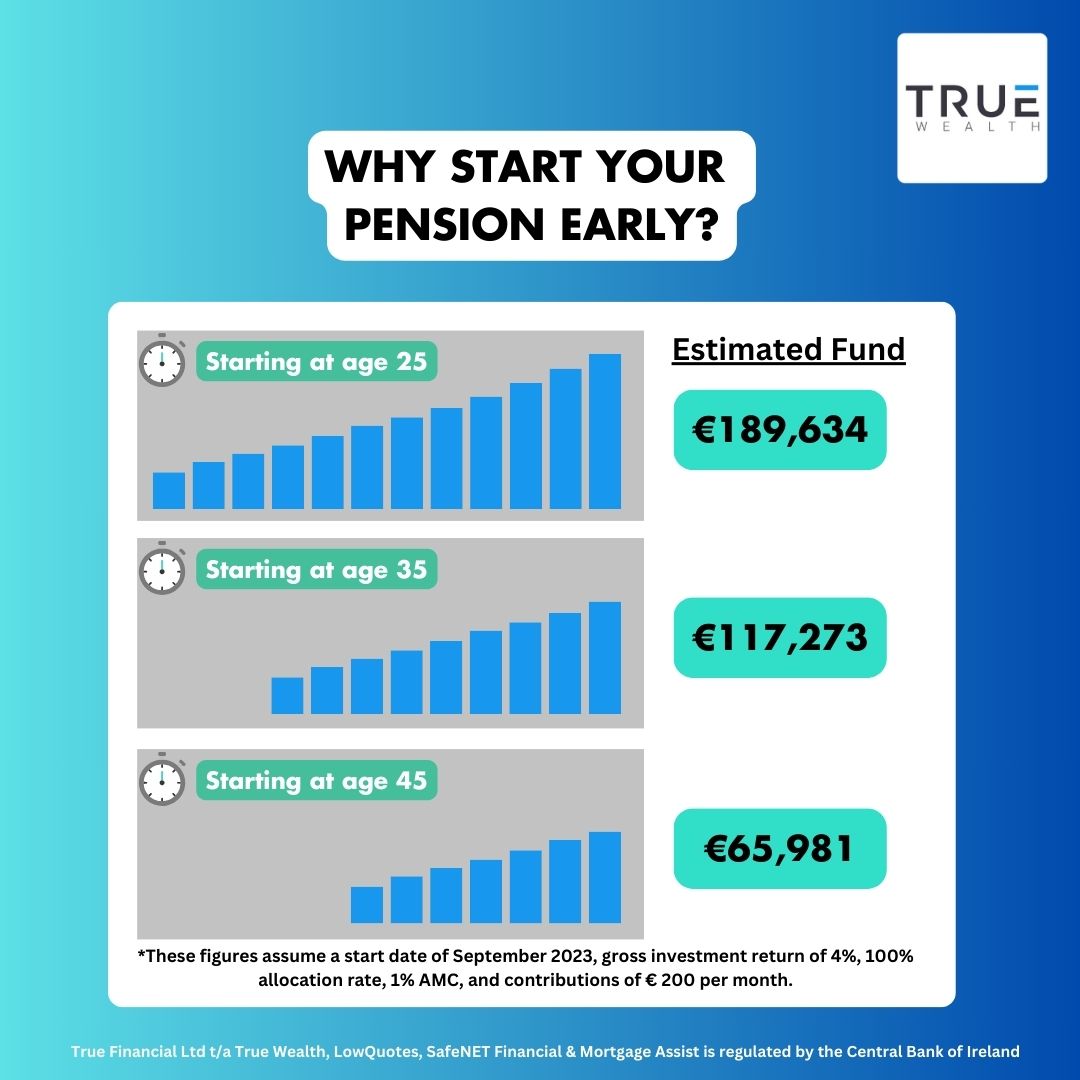

The best time to start a pension is unquestionably in your 20s. Beginning in your 20s provides you with the longest runway to save and invest, taking full advantage of the power of compounding. We love compounding here at True Wealth, it’s literally free money gifted to you, interest building on top of interest you have already earned, what’s not to love?

Many employers in Ireland offer occupational pension schemes, which can be a convenient way to begin saving for your retirement, and you can add to this pension fund with your own personal contributions to boost the pot.

Alternatively, you can start your own pension plan, giving you full control and flexibility in managing your financial future, that’s where a financial adviser comes in handy, and yep.. You guessed it, we advise on all pensions across the board.

Why should I start a private pension?

There are several benefits and reasons why you should start planning your retirement in your 20s.

More Time to Contribute

Beginning retirement planning at a young age provides you with the gift of time. The longer you save and invest, the more your money can grow through the magic of compounding. I’ll say it again: we love compound interest. (literally free money)

This means you’ll need to contribute less each month to reach your retirement goals, or you can just have a really nice and comfortable life in retirement, you know you deserve it.

State Pension May Fall Short

In 2023, the weekly state pension rate in Ireland is €265.30, and the retirement age is 66.

According to the Central Statistics Office the average weekly wage was €900.26 in Q4 2022.

We know and understand that you may not need your historic wage at retirement age. But the fall off is steep and it’s recognised to be a real issue in this country. Why else would the government give you back up to 40% of your payments? You know it’s a serious issue when the government incentivises you heavily to provide for your own retirement. (So you won’t be leaning on them in the future)

While the State Pension offers essential support, it might not be sufficient to maintain your desired lifestyle during retirement.

As your career progresses, your earnings will likely increase. When you retire, the gap between your salary and the State Pension becomes more evident. Early retirement planning helps bridge that gap.

Longer Life Expectancy

People in Ireland are living longer, with an average life expectancy of 93.6 years for those born in 2021. This is good news for all of us, but needs to be planned for.

This extended lifespan means that you may need more savings to maintain a comfortable standard of living in retirement.

Starting early allows you to accumulate the necessary funds for a longer retirement.

Compound Interest

Did I say we love this?… Time is your greatest ally when it comes to building wealth through investments.

By starting your pension early, your money has more time to grow through compounding.

This means that the interest you earn on your investments generates more interest over time, creating a snowball effect that can significantly boost your retirement savings.

Tax Benefits

Private pensions offer excellent tax incentives. Contributing to your pension can reduce your taxable income, providing an immediate financial benefit. So the money goes into my pension rather than to the government? Okaaaaay, I think I will pay myself instead of the government through higher income tax. It’s a no brainer folks.

Additionally, your pension fund grows tax-free until retirement, allowing you to maximise your savings.

Get a Retirement and Pension Planning Quote

Explore our article that delves into 9 Reasons to Have a Private Pension in Ireland. By reading our article, you’ll be able to understand how important having a private pension is and make informed decisions.

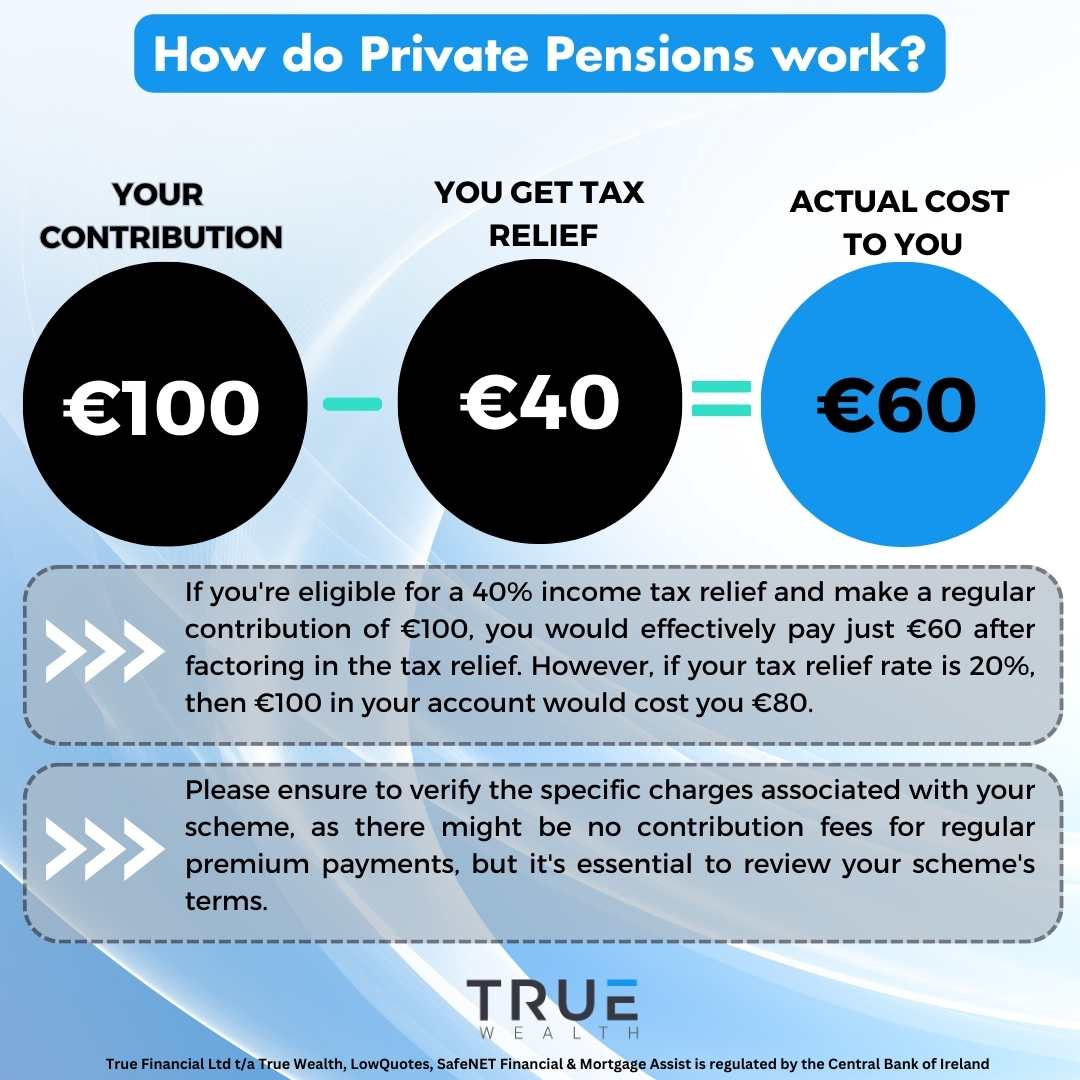

How do private pensions work?

When you put money into your private pension, the government offers tax relief on those contributions.

This means that the money you contribute to your pension is deducted from your taxable income, reducing the amount of income that is subject to taxation.

As a result, you’ll end up paying less in taxes. The level of tax relief you receive depends on your income and the tax rate applicable to you.

For example, if you are in the higher tax bracket and you contribute €100 to your private pension, you may receive €40 in tax relief, effectively reducing the cost of your contribution to €60.

This tax relief can significantly boost your retirement savings over time.

Furthermore, a private pension allows you to take control of your retirement savings, offering flexibility in investment choices and providing opportunities for your contributions to grow over the years.

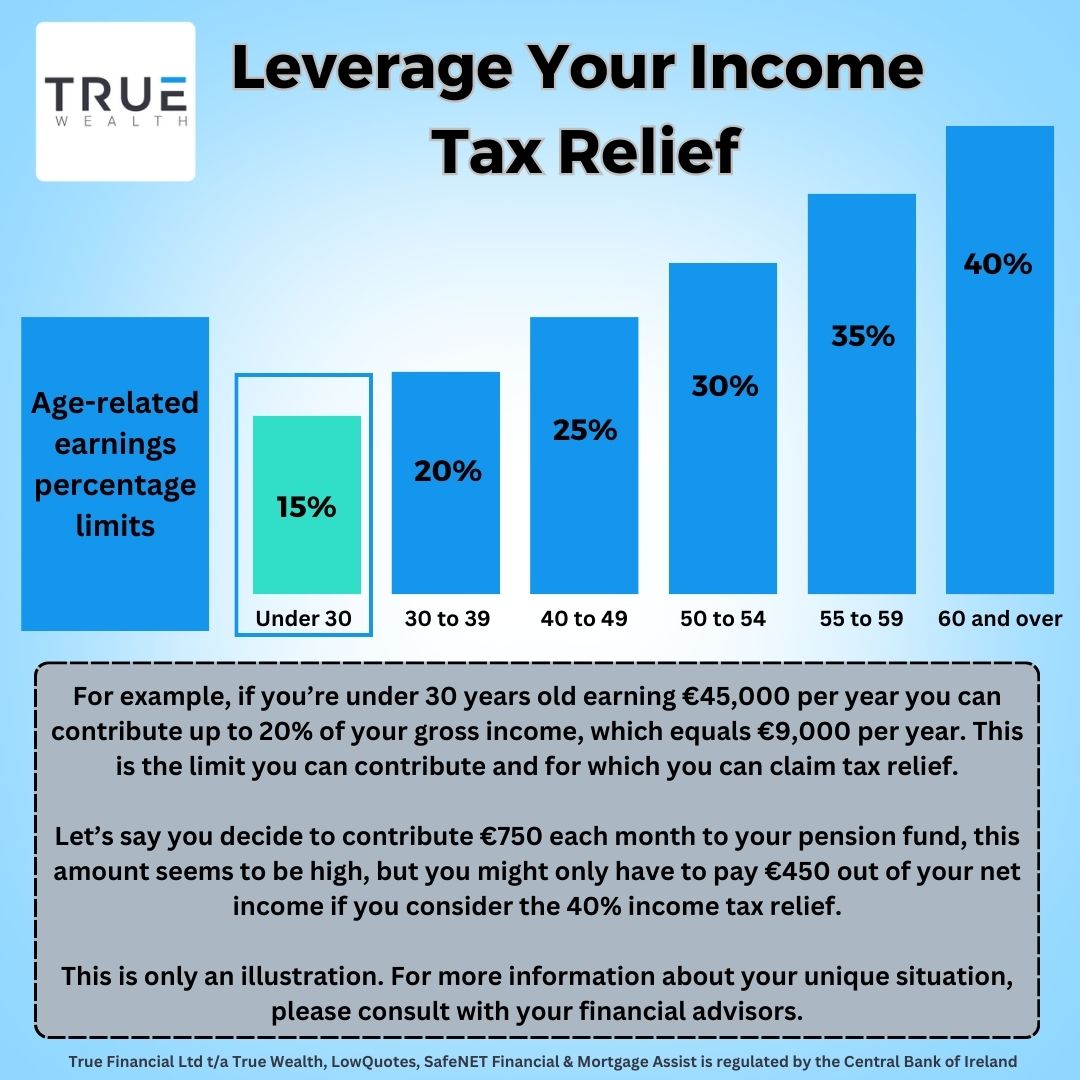

How much should you save into your pension pot?

If you already have a pension, the exact amount to save for it depends on your unique situation and disposable income.

If you’re 20 years old, you can set aside up to 15% of your income for your pension and claim full tax relief. While this might seem like a lot, tax relief can make it easier to manage.

For instance, you’re earning €45,000 per year and decide to contribute €750 each month to your pension fund. This amount seems to be high, but you might only have to pay €450 out of your net income if you consider the 40% income tax relief.

Navigating the world of pensions can be a complex task, especially when you’re in your 20s.

We understand that it’s not always easy to determine the right amount to contribute to your pension pot to secure your future. That’s where our expertise comes in.

True Wealth is here to provide tailored pension guidance – get a quote today.

Get a Retirement and Pension Planning Quote

Steps to planning for your retirement in your 20s

1. Just Start

The most important advice for saving for retirement is to begin saving money for it.

The very first and most powerful step you can take is to make it a habit to set aside a portion of your earnings in a special retirement account every time you get paid, even if it’s just a small amount.

2. Set your Retirement Goals

In your 20s, it’s important to begin thinking about your retirement goals.

First, imagine what you want your retirement to be like – whether it’s travelling, enjoying hobbies, or just having a comfortable life.

Decide when you want to stop working and estimate how much money you’ll need for your retirement.

Discuss this with us, and we’ll help you determine your required income in retirement as well as the best way to achieve your retirement goals.

3. Create a Budget

Creating a budget is a crucial element of your financial strategy. Pinpoint areas where you can cut unnecessary expenses and redirect those savings towards your pension fund.

Our free personal budget planner is a valuable resource for those looking to manage their finances effectively.

By creating a monthly budget and consistently tracking your earnings, expenses, savings, and investments, you can strengthen your financial outlook and make informed decisions about where to allocate your money.

4. Understand the basics

Familiarise yourself with the basics of retirement planning. Learn about the State Pension, Occupational Pension Schemes, Personal Pension Plan, and tax relief.

The State Pension

The State Pension provides financial assistance to eligible retirees. Understanding the eligibility criteria, payment amounts and any potential changes to the State Pension over the years is fundamental.

Keep in mind that while it provides a foundation, the State Pension might not be sufficient to cover all your retirement needs, making it essential to supplement it with a private pension.

Occupational Pension Schemes

Occupational Pension Schemes are retirement plans organised by your employer to assist you in saving for your retirement.

It’s important to find out if your employer provides such a plan and be informed about the specifics, such as how much you and your employer contribute, how long you need to work there to receive the benefits, and whether your employer matches your contributions.

These plans can be very helpful because they often come with extra money from your employer and tax advantages.

Personal Pension Plans

Personal Pension Plans are individual retirement accounts that you can set up independently.

These plans offer you flexibility and control over your retirement savings.

Understanding the various types of Personal Pension Plans available in Ireland and their investment options is key.

These plans allow you to tailor your contributions and investments to align with your specific retirement goals.

We can help you choose the best strategy for your retirement plan, get in touch with one or our financial advisors.

Tax Relief

Tax relief is a significant advantage when it comes to pension contributions.

It reduces the amount of income subject to taxation, essentially lowering your overall tax bill.

Tax relief makes pension contributions more tax-efficient and can significantly boost your retirement savings. It’s a financial incentive designed to encourage people to save for their retirement.

The exact tax benefits and rules can vary, so it’s advisable to consult with one of our financial advisors at True Wealth.

Get a Retirement and Pension Planning Quote

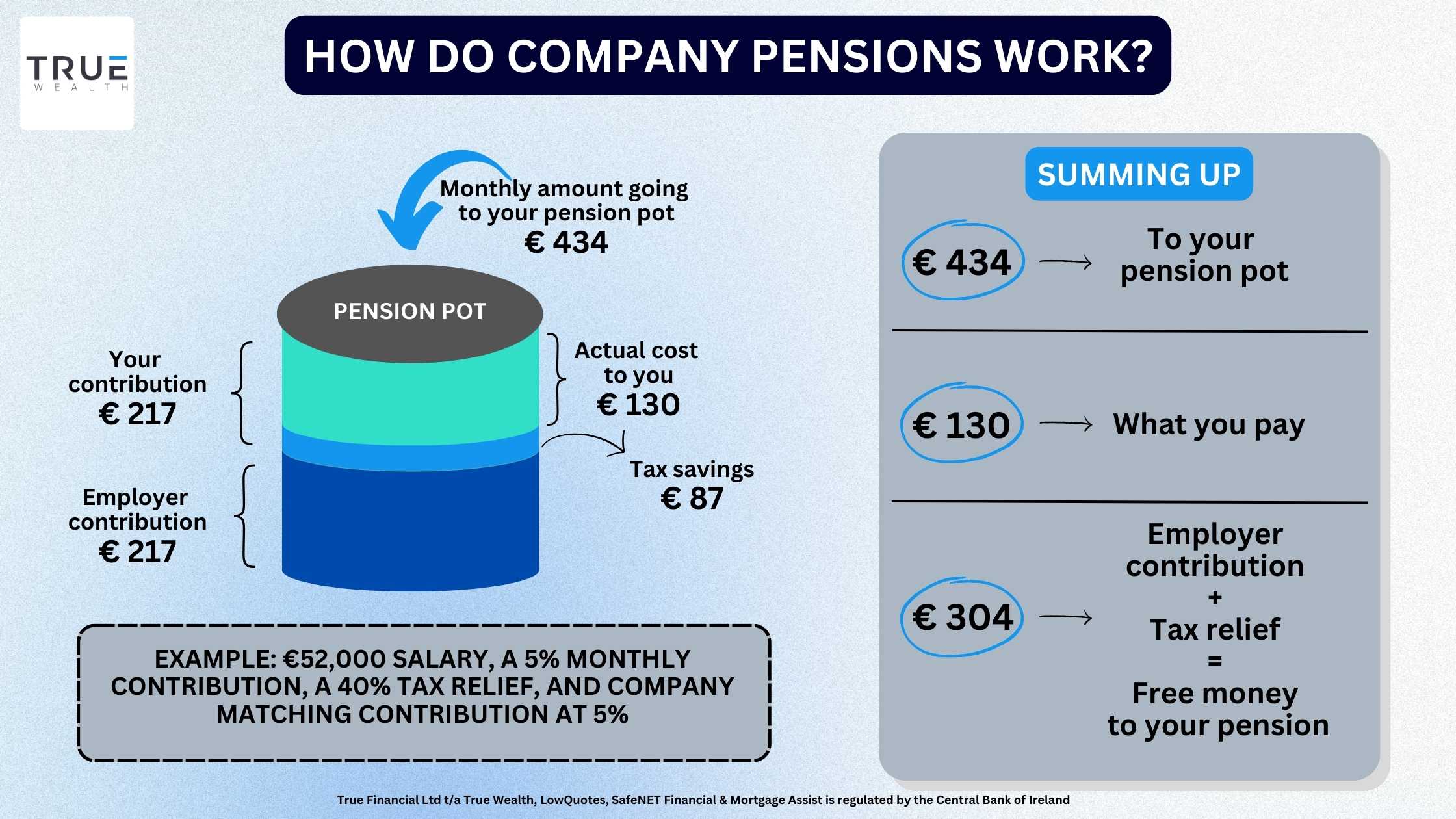

5. Take advantage of your employer’s schemes

Taking advantage of your employer’s pension scheme in your 20s is a smart financial move that can set you on the path to a secure retirement.

Enrol in the scheme as soon as you’re eligible. Many employer schemes have a waiting period before you can join, so don’t delay once you’re eligible.

If your employer offers a pension plan with matching contributions, be sure to take full advantage of this opportunity.

Your employer’s contributions can significantly increase your retirement savings, essentially giving you free money for your retirement fund.

For example, consider a situation where you’re employed and are part of your company’s pension plan.

Your annual salary is €52,000, and you contribute 5% of your salary every month.

Your company matches your contribution at 5%. Additionally, your income places you in the 40% tax bracket.

Both you and your employer contribute €217 each, totaling €434.

What’s important to note here is that thanks to tax relief, your actual expense is only €130.

This means you can enhance your pension savings while spending less, all thanks to the tax relief benefit.

5. Understand Your Investment Options

Understand the investment options within your pension scheme.

You have choices on how your contributions are invested. Assess your risk tolerance and select investments that align with your retirement goals.

It’s always advisable to diversify your investments to spread risk and potentially increase your returns. Explore options like stocks, bonds, property, and other assets.

You can get professional guidance from our financial advisors at True Wealth.

6. Seek Professional Advice

Seeking professional advice in your 20s while planning for your retirement can be a game-changing decision that significantly enhances your financial security in later years.

We at True Wealth specialise in retirement and pension planning. We possess in-depth knowledge of various retirement investment options, tax strategies, and pension schemes.

Our expertise can help you make well-informed decisions tailored to your unique financial situation and goals.

Get a Retirement and Pension Planning Quote

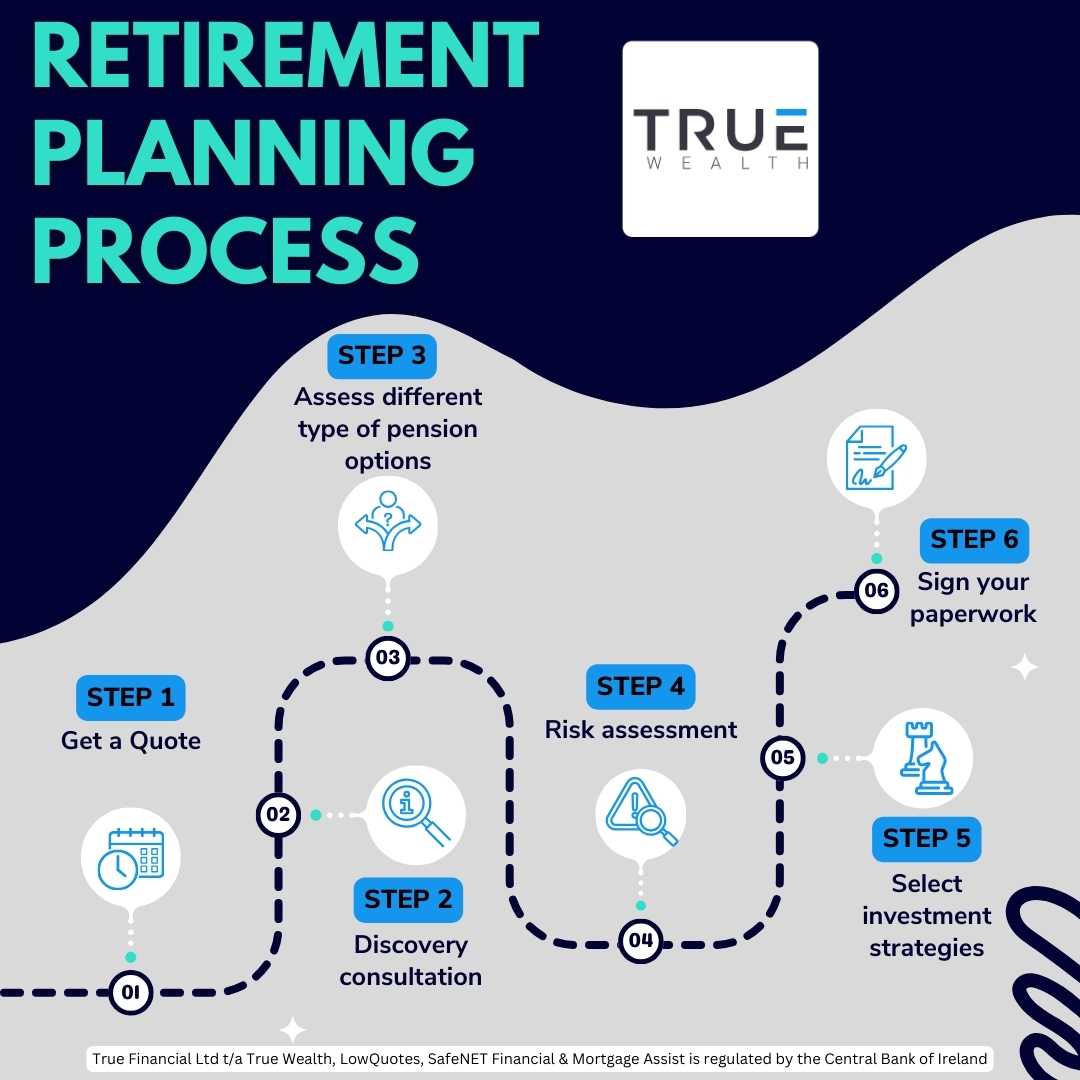

What is the Retirement Planning Process with True Wealth?

At True Wealth, we understand the importance of effective retirement planning and take pride in guiding our clients through each step of the process.

From the initial consultation to signing the paperwork, our dedicated team of financial advisors is with you every step of the way.

1. Get a quote

The first step in your Retirement Planning journey begins with getting a quote.

You will be asked some quick questions which will help us to pair you with a financial advisor to suit your unique situation.

2. Discovery consultation

During our discovery consultation, we provide you with your quote, and you’ll have the chance to have a one-on-one conversation with your dedicated financial advisor.

Your advisor will invest the time to grasp your unique situation and expectations, setting a solid groundwork for your retirement strategy.

Crafting a custom retirement plan involves a comprehensive fact-finding process. This entails collecting data about your current financial position, your comfort level with risk, your preferred investment options, and the timeline for your retirement.

This step is pivotal in evaluating the appropriateness of various pension options.

3. Assess different types of pension options

Our team will present you with a range of pension options tailored to your specific needs.

We will explain the advantages and disadvantages of each, ensuring you have a clear understanding of your choices.

This comprehensive assessment helps you make an informed decision about your pension plan.

5. Risk Assessment

Understanding your risk tolerance is fundamental to the pension process.

We will work with you to assess your comfort level with different levels of risk.

This information will guide the development of an investment strategy that aligns with your preferences and goals.

Usually for individuals in their 20s, our recommendation typically leans towards a strategy with lower to moderate risk.

6. Select investment strategies

Based on the risk assessment and your long-term objectives, we will recommend investment strategies that maximise your retirement savings.

Whether you prefer a conservative approach, an aggressive strategy, or something in between, our goal is to create a diversified investment portfolio that suits your needs.

7. Sign your paperwork

Once you are satisfied with your retirement plan and investment strategy, it’s time to sign the necessary paperwork to put your retirement plan in action.

Our team will walk you through all documentation, ensuring that you understand each aspect of your pension arrangement.

Your Retirement in Your 20s with True Wealth

At True Wealth, we understand that retirement planning isn’t the same for everyone, especially when you’re in your 20s.

We’re here to collaborate with you, creating a customised strategy that matches your specific financial circumstances, the way you live, and what you want from your retirement.

This personalised method guarantees that your plan is perfectly crafted to match your expectations.

Seeking professional advice from True Wealth is an investment in your future.

Don’t limit your retirement to the State pension; partner with True Wealth for a well-structured and tailored retirement plan.

We are also experts in personal and business protection, savings and investments, pension tracing, personal and business financial planning, mortgages, and wealth extraction.

Get a Retirement and Pension Planning Quote

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down and up.

Warning: If you invest in this product, you will not have any access to your money until you retire.

Warning: If you invest in this product, you may lose some or all of your investment.

Warning: This product may be affected by changes in currency exchange rates.

What is an Approved Retirement Fund (ARF)?