Budgeting For Couples: How to Build Financial Harmony

Table of Contents

A crucial component of every relationship is managing finances as a couple. Even though it’s not the most romantic subject, budgeting is the cornerstone of a secure and harmonious financial future. However, navigating the waters of joint financial planning can sometimes be challenging, leading to misunderstandings and conflicts.

According to a survey, one of the top five reasons married couples argue is Money. This is because couples often have different personal views on how to manage money.

Five Reasons Couples Clash Over Finances

It’s true that financial disagreements about money often lead to tension within many couples. Here are some of the main reasons why couples argue about how money is spent:

Divergent Financial Values and Priorities

One of the most significant reasons for money-related conflicts in relationships is when partners have different financial values and priorities. For example, one spouse might prioritise savings for the future or long-term investments, while the other tends to make impulsive purchases or overspend. This can cause frustration and concern for the other spouse, who may prefer a more frugal approach.

Lack of Communication

Communication is essential in any relationship, especially when it comes to finances. Problems arise when couples are unable to communicate openly about their individual spending habits, financial goals, and concerns. Financial conflicts might get more heated if there are hidden purchases or debts, which can cause feelings of betrayal and distrust.

Not having a personal financial strategy

If one partner is not organised with money and doesn’t have any personal financial planning, bills may be paid late, important documents may be lost, and there may be a tendency to overspend on credit without a clear strategy for debt repayment.

Lack of organisation can lead to difficulties in tracking daily expenses, making it challenging to budget effectively and understand where money is being spent.

Resentment and Burden

The partner who takes on the responsibility of managing finances may start to feel burdened and resentful, especially if they think that the other partner is not contributing or is not taking the financial aspect of the relationship seriously. This can lead to increased stress and potential arguments.

When one partner earns much more than the other, or when one spouse is unemployed or earns a lower income, financial tensions can arise. Feelings of resentment and unfairness might result from the impression of unequal contributions to shared costs.

Planning for a Secure Financial Future

Achieving long-term goals can be challenging for couples, and differing strategies to achieve those goals can lead to arguments. For example, they might find it difficult to define the best strategy to save money for their children’s education or how to plan for retirement.

Having a financial plan in place will provide a safety net during times of economic uncertainty or unforeseen life events. Without it, couples can find themselves unprepared to handle financial crises.

Get a Financial Planning Quote

8 Tips to get started budgeting as a couple

1. Open Communication is Key

Open and honest communication is one of the essential elements of successful budgeting for couples. It’s important to create a secure and judgement-free environment for talking about one’s financial goals, problems, and objectives because talking about money can be sensitive.

Be open and honest about your personal finances, including your debts, assets, and spending patterns. You can prevent future surprises and work towards common financial goals by being honest with each other.

2. Assess Income and Expenses

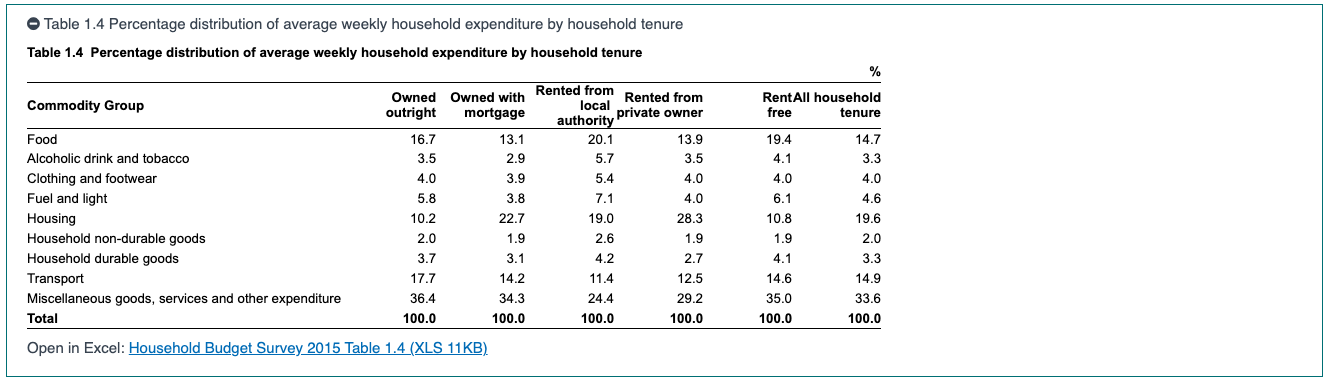

Take a comprehensive look at your combined income and expenses. List all sources of income and group your regular expenditures into categories, including rent or mortgage, utilities, food, transportation, and entertainment. Don’t forget to account for sporadic spending and on-time costs for occasions like birthdays and holidays.

According to the Central Statistics Office, the estimated average weekly expenditure in 2015-2016 for all households in the State was €837.47, or around €43.000 per year.

For example:

Let’s consider a fictional couple, Jimmy and Maeve, living in Ireland during 2015–2016. Based on the estimated average weekly expenditure provided by the CSO, we can analyse their spending habits.

Jimmy and Maeve, both working professionals, closely monitor their expenses to maintain a balanced budget.

Weekly spending:

Housing Expenses: They pay €1,200 per month in rent for their apartment, which amounts to €300 per week.

Groceries: They spend approximately €150 per week on groceries and household essentials.

Transportation: As they use public transportation to commute to work, their combined weekly spending on transport is about €50.

Utilities: Jimmy and Maeve allocate around €50 per week for utility bills, including electricity, water, and internet.

Eating Out and Entertainment: They enjoy dining out occasionally and participating in leisure activities. They set aside €100 per week for entertainment expenses.

Savings and Investments: They are diligent savers and aim to invest for their future. They manage to save around €100 per week.

Considering the above categories, their estimated total weekly expenditure is:

€300 (Housing) + €150 (Groceries) + €50 (Transportation) + €50 (Utilities) + €100 (Eating Out & Entertainment) + €100 (Savings) = €750 per week.

This amount is slightly below the estimated average weekly expenditure of €837.47 for all households in the State during 2015–2016. Jimmy and Maeve are able to live within their means and have some savings for unforeseen expenses or future plans because of their financial discipline and responsible spending practises.

Note that this is just a fictional example, and individual households’ spending can vary widely based on their income, lifestyle, and other factors. The estimated average provided by the Central Statistics Office serves as a general indicator of the overall spending trends in Ireland during the specified period.

3. Set Mutual Financial Goals

Start by discussing your long-term financial objectives as a couple. Whether it’s buying a house, paying off debts, saving for holidays, or planning for retirement, align your goals to create a unified vision. Having shared aspirations will make it easier to stay motivated and committed to the budgeting process.

An excellent way for improving your financial status and working on mutual financial goals is to set SMART goals for your joint budgeting. SMART goals are specific, measurable, achievable, relevant, and time-bound. Here is an example of SMART goals for budgeting as a couple:

Note that your financial goals for your future will change depending on what life stage you are in. If you want some insights about this topic, read our article How to set financial goals for your future in your 20s, 30s, 40s, 50, and 60s

Get a Financial Planning Quote

4. Create a Realistic Budget

Based on your income and expenses, create a budget that reflects your financial goals. Be realistic and avoid overestimating income or underestimating expenses. Allocate a specific portion of your income to savings and investments, and make sure to set aside an emergency fund to cover unexpected costs.

To begin creating your budget, list out all of the expected income that you and your spouse will receive during the time period that you’re budgeting for. Again, this could be a week, two weeks, or even a month.

5. Designate Roles and Responsibilities

Based on the skills and interests of each partner, divide the budgeting responsibilities. While one partner may excel at long-term financial planning or investment decisions, the other may prefer keeping track of costs and developing budgets. Roles can be assigned to avoid duplication of effort and to guarantee that both partners are actively participating in the financial process.

6. Shared spreadsheets or our budget planner

You can save your budget spreadsheet on Google Drive so that both you and your spouse will always have access to it from various devices and can edit it at any time.

We offer a free personal budget planner that can be incredibly helpful for individuals and families to manage their finances effectively. You are able to set monthly budgets, track income, expenses, and investments, gain better control over your financial situation, and make informed decisions on where to save money.

7. Regularly Review and Adjust

A budget is not static; it should evolve with your changing financial situation and life circumstances. To assess progress, talk about obstacles, and make necessary adjustments, schedule regular budget reviews as a pair. Updating your budget in response to life changes like a new job, a promotion, or significant purchases may be necessary.

8. Seek Professional Advice

Seeking professional advice can be a smart move to gain insights and develop a solid financial plan. An expert financial advisor can provide an unbiased perspective on your financial situation. They can offer a neutral view and help you make decisions based on data and analysis rather than emotions.

Get in touch with True Wealth

We at True Wealth are experts in personal and business financial planning, retirement planning, pension tracing, savings and investments, and wealth management.

We can understand your unique financial situation, goals, and risk tolerance to create a personalised plan that aligns with your aspirations. We are able to help you navigate complex financial matters, optimise your investments, manage debt effectively, and plan for retirement or other major life events.

With our expert guidance, budgeting as a couple can become a more manageable and rewarding process.

Get a Financial Planning Quote

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

What Is The Best Way To Save For Your Child’s College Education?