Multi-Claim Protection Cover offers comprehensive protection across various insurance needs in a single policy. Whether you need health, income, or critical illness coverage, this policy consolidates these protections into a cost-effective package. It ensures a holistic safety net that adapts to your changing circumstances, simplifying your insurance management while maximising coverage.

Multi-Claim Protection Cover is essential for several reasons:

No matter where you are on life’s journey, the choices you make today will impact your family’s future.

Don’t wait any longer! Get a quote today!

Protect your loved ones. Get a quote for Life Insurance today!

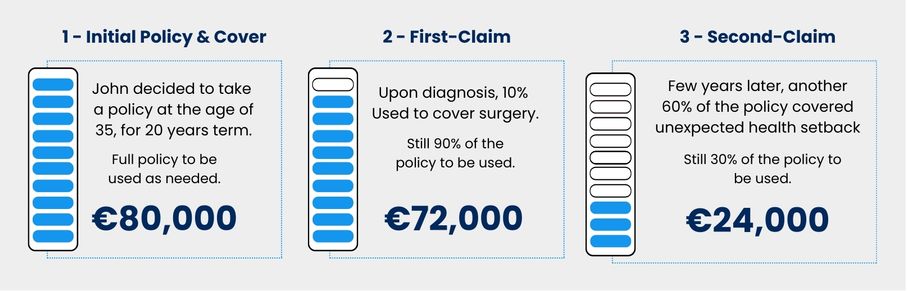

Multi-Claim Protection Cover is designed to provide financial support in the event of serious health issues by paying out portions of the total coverage amount as needed. Here’s how it works, illustrated through John’s experience:

Initial Policy and Coverage

First Claim: Cancer Diagnosis

Second Claim: Testicular Cancer Diagnosis

Through this Multi-Claim Protection Cover, John receives timely financial support for his medical expenses, ensuring he can focus on recovery without financial stress. This type of policy allows multiple claims, reducing the total coverage amount available with each payout but ensuring continuous support through various health challenges.

By understanding the different types of policies and their benefits, you can make informed decisions to protect your financial future and well-being.

Receive expert support securing the best insurance and protection policies here at True Wealth. Taking the first step towards a worry-free future is reaching out to us for a consultation today.

Multi-claim protection Coverage typically covers a wide range of serious illnesses and conditions, including, but not limited to, cancer, heart attacks, strokes, and severe accidents. The specific illnesses covered will depend on the terms of your policy, so it’s essential to review the policy documents or consult with one of our expert advisors to understand the full scope of coverage.

No, you can make no specific maximum number of claims with your Multi-Claim Protection Cover policy. You can continue to make claims until the total sum assured is exhausted. Each claim reduces the remaining available coverage, ensuring continuous financial support through various health challenges until the full coverage amount is utilised.

The severity-based payout in Multi-Claim Protection Cover means that the amount you receive depends on the severity of the illness or condition diagnosed. For instance, a minor illness might result in a smaller payout, whereas a more severe illness or condition will trigger a larger payout. This approach ensures that you receive appropriate financial support based on the impact of the health issue on your life.

Income, Life, Mortgage, Health, Serious Illness Protection

Freephone (1800) 808-808

Maximise your retirement potential and achieve your financial goals with a tax-efficient financial review. Schedule your consultation today with our award-winning advisors and enjoy the benefits of a well-planned financial future.

Make informed decisions. Explore our articles and stay up-to-date.

Subscribe to our YouTube Channel and explore our insights and tips, empowering you to make informed decisions that will not only protect your future and loved ones, while also ensuring you achieve all your financial goals.

At True Wealth, we believe everyone deserves access to expert financial advice, regardless of their current wealth or financial situation. If you have a passion for connecting with people and aspire to thrive in a culture built on trust, integrity, dedication, and excellence, this could be the perfect fit. Let’s grow together!