Retirement Planning in Your 40s

Table of Contents

Reaching the age of 40 is a pivotal moment in your financial journey, particularly when it comes to retirement planning in Ireland.

Life moves on, the kids are getting older, things seem more settled, we are getting a grip on our money, we may be starting to accumulate excess funds, I dare say we get more sense, financial decisions need to be made and the importance of these topics increases.

If you haven’t started a pension, it’s advisable to take action as soon as possible. Starting your pension now not only allows you to benefit from income tax relief but also provides you with plenty of time to build up a substantial pension fund.

If you already have a pension, it’s common to set it aside and not think about it. However, remember that your pension is an investment that needs your attention regularly.

You might be overlooking potential tax benefits and it’s always very positive to look forward to the future and to get excited about your future goals: relaxed, thriving retirement, good times with the grandkids, and watching your family prosper. It’s something to look forward to but also be prepared for.

Also, you could be consistently contributing the same amount to your pension as when you began; even if your income has increased since then, things never stay the same, and your pension contributions will likely be the same.

Is it Too Late to Start a Pension at 40?

The short answer is no.

It’s never too late to start saving for retirement. While it’s ideal to begin saving in your 20s or 30s, starting in your 40s still provides ample time to build a comfortable nest egg.

You could even do it better in your 40s and make up for the lost time; you could have more miscellaneous income; you could just care more about your retirement fund.

Most people in their 40s end up in this situation: they loom around and think, heh, things aren’t going too bad for me, life is settling down, I have my home, I can predict certain life events.

Where can it go wrong? And the answer is: your income stops, what scenario is that, well retirement even unplanned retirement.

The key is to be proactive and make informed decisions around your future.

Why should I start a private pension?

Having a private pension is of great importance for a variety of reasons. It is necessary to secure a comfortable retirement or maintain your current standard of living, as the state pension alone may not be sufficient to meet all your financial needs.

One of the main reasons for having a private pension is to enhance and complement the State Pension.

While the State Pension provides a valuable level of financial support for retirees, it may not be sufficient to keep the standard of living or meet all financial needs in retirement.

You need to assess the bills and expenses you’re likely to have in retirement and determine whether the State Pension of €265 per week (as of January 2023) will adequately cover your financial needs.

If you find that it falls short, a private pension becomes essential to ensure your financial security during your golden years.

Explore our article that delves into 9 Reasons to Have a Private Pension in Ireland. By reading our article, you’ll be able to understand how important having a private pension is and make informed decisions.

Get a Retirement and Pension Planning Quote

How much should you save into your pension?

If you already have a pension, the right amount to save for it depends on your unique situation and disposable income.

Really and truly, you need help from a financial advisor that’s on your team, routing for you, and that’s us in a nutshell here at True Wealth. We are on team you!

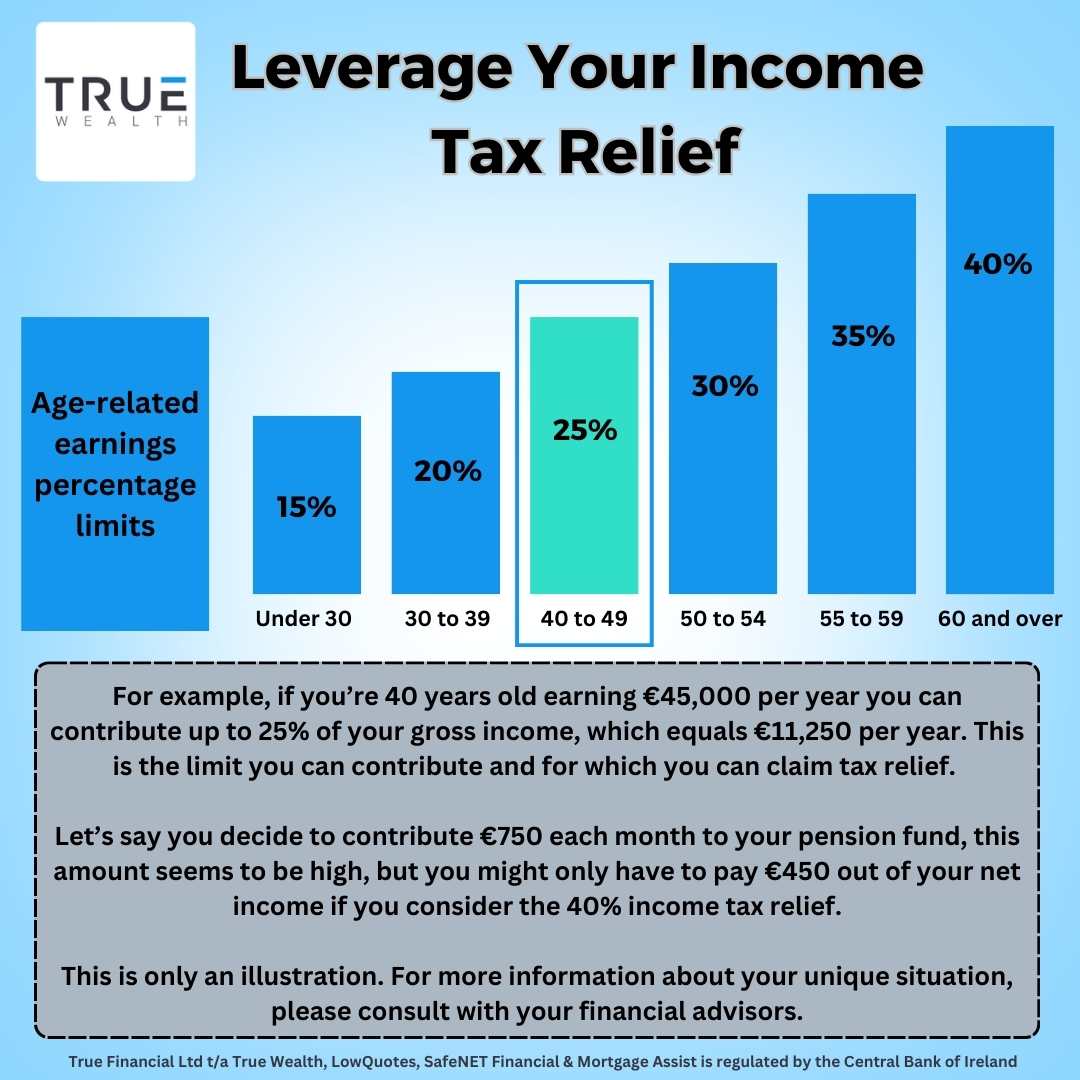

If you’re 40 years old, you can set aside up to 25% of your income for your pension claiming full tax relief. While this might seem like a lot, tax relief can make it easier to manage.

For instance, you’re earning €45,000 per year and decide to contribute €750 each month to your pension fund. This amount seems to be high, but you might only have to pay €450 out of your net income if you consider the 40% income tax relief.

Steps to planning for your retirement in your 40s

1. Assess Your Current Financial Situation

The first step in your retirement planning journey is to evaluate your current financial status. Take a close look at your income, monthly expenses, outstanding debts, and existing savings.

Understanding where you stand financially is crucial when you set your retirement goals.

2. Define your Retirement Goals

When you’re in your 40s, it’s the ideal time to define or review your retirement objectives and set the stage for a secure financial future. To map your course, consider the following factors in shaping your retirement goals:

Visualise Your Desired Retirement Lifestyle

Begin by painting a picture of your dream retirement. Visualise where you want to live, the activities you hope to enjoy, and the type of lifestyle you aspire to lead. Think about elements such as travel, hobbies, and quality time with family.

Select Your Retirement Age

Choose the age at which you intend to retire. Your chosen retirement age will play a significant role in determining your savings target and the time available to accomplish your goals.

Estimate Future Expenses

To project your future expenses, examine your current spending habits and consider how they might change during retirement. Include essential costs like housing, healthcare, and everyday living, while also accounting for daily spending on leisure activities.

Remember to consider potential reductions in expenses once your children have grown and left home, as these adjustments can have a substantial impact on your financial planning.

Determine Your Desired Income

Calculate the income required for your retirement to maintain your preferred lifestyle, covering both necessary and discretionary expenses.

Feel free to discuss these aspects with us, and we’ll help you determine your necessary retirement income as well as create a tailored strategy to achieve your retirement expectations.

3. Create a Realistic Budget

Building a budget is an essential part of your financial plan. Identify areas where you can cut back on unnecessary spending and allocate those savings towards your retirement fund.

Our free personal budget planner is a valuable resource for those looking to manage their finances effectively.

By creating a monthly budget and diligently monitoring your income, expenses, savings, and investments, you can enhance your financial outlook and make informed decisions about where to allocate your money.

Get a Retirement and Pension Planning Quote

4. Take Advantage of Tax Relief

Tax relief can be a powerful tool to boost your retirement savings. The Irish government encourages retirement savings by offering tax incentives to individuals who contribute to pension plans.

Contributions to these pension plans are often tax-deductible, meaning you can reduce your taxable income by the amount you invest. This results in immediate tax savings and more money available for your retirement fund.

By taking full advantage of available tax relief options, you not only reduce your current tax liability but also supercharge your retirement savings. This strategy makes your money work better for your future, bringing you closer to your retirement goals.

The exact tax benefits and rules can vary, so it’s advisable to consult with one of our financial advisors at True Wealth.

5. Increase Contributions Annually

Make a commitment to increase your retirement contributions each year, even if it’s a small increase. This practise can take advantage of compounding and help grow your retirement savings substantially over time, if your income increases or your expenditure reduces, offset it into your pension and earn the tax relief, it takes discipline, but it’s the good life.

Situations where you can increase contributions:

Promotion or pay rise

Both a promotion and a pay raise provide opportunities to increase your pension contributions. A promotion allows you to utilise the extra income while maintaining your lifestyle, while a pay raise, whether annual or as a bonus, can be allocated towards your pension contributions, accelerating your retirement savings.

Windfalls

Unexpected financial windfalls, such as an inheritance or a financial gift, might significantly increase your retirement savings. Consider increasing your pension payments with some of these windfalls rather than spending them all on expensive goods.

Reduction in Expenses

If you find ways to reduce your living expenses, consider redirecting the money saved into your retirement fund.

For example:

Consider that you’ve recently switched your mortgage to secure a lower interest rate, which has led to a substantial reduction in your monthly mortgage payments.

Additionally, you’ve reviewed your mortgage protection plan and found a more cost-effective policy that still provides the necessary coverage. These two financial decisions result in significant savings each month.

Before these changes, your mortgage and mortgage protection expenses were substantial portions of your monthly budget. However, with the new, more affordable terms, you now find yourself with extra funds at your disposal.

Instead of allowing this money to be absorbed by daily expenses or discretionary spending, you decide to be proactive in securing your retirement.

By redirecting these funds, you not only make the most of your reduced expenses, but also leverage the power of compound interest, ensuring that you’re well-prepared for your retirement in Ireland.

Employer Contributions Matching

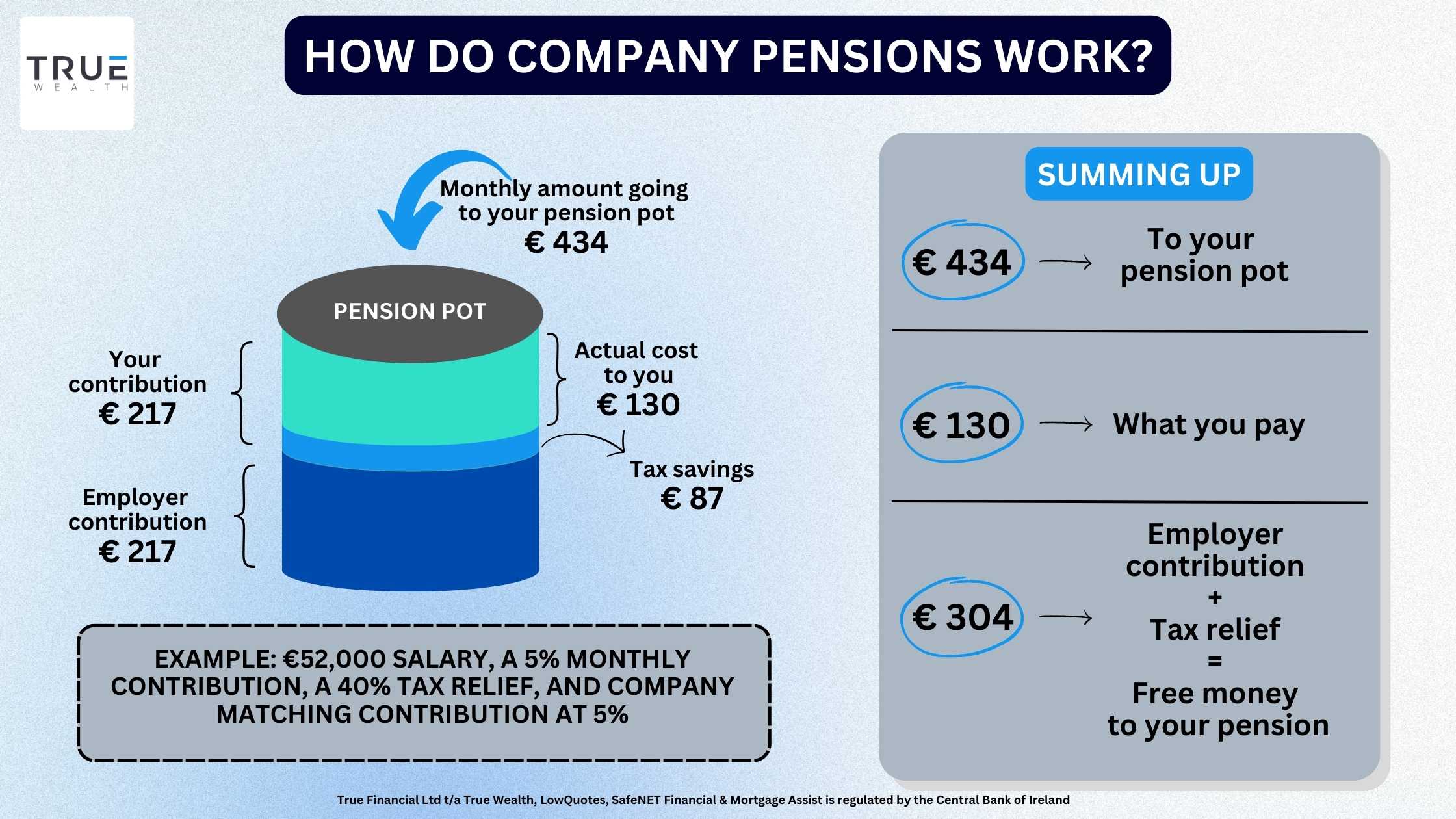

If your employer offers a matching programme for your pension contributions, consider increasing your contributions to maximise this matching benefit. It’s essentially “free money” that can significantly boost your retirement savings.

Example:

Consider the scenario where you work for a company that offers a pension plan with an employer matching programme. This means that for every euro you contribute to your pension, your employer matches that contribution up to a certain percentage of your salary.

Initially, you’ve been contributing 5% of your monthly salary to your pension, and your employer matches that 5%. However, you’ve recently learned that your employer is willing to match contributions up to 8% of your salary.

Realising the potential benefit, you decide to increase your contributions from 5% to 8%. This change does not significantly impact your current net income since it’s a pre-tax contribution.

In essence, you’re taking advantage of this “free money” offered by your employer, and you’re essentially receiving a 3% salary increase in the form of matching contributions.

Over time, these additional contributions and the matching funds accumulate and grow through investments.

Get a Retirement and Pension Planning Quote

6. Optimise Your Asset Allocation

Asset allocation is a critical factor in your retirement strategy.

As you move through your 40s, consider revisiting your investment portfolio and making sure it aligns with your risk tolerance and retirement goals.

You might want to shift to a more conservative asset allocation to protect your savings from market volatility while still seeking opportunities for growth.

Regularly review your portfolio to maintain your desired asset mix. You can get professional guidance from our financial advisors at True Wealth.

7. Seek Professional Advice

Working with our financial advisors at True Wealth can provide you with tailored guidance, ensuring that your retirement savings plan aligns with your unique financial situation and retirement goals.

What is the Retirement Planning Process with True Wealth?

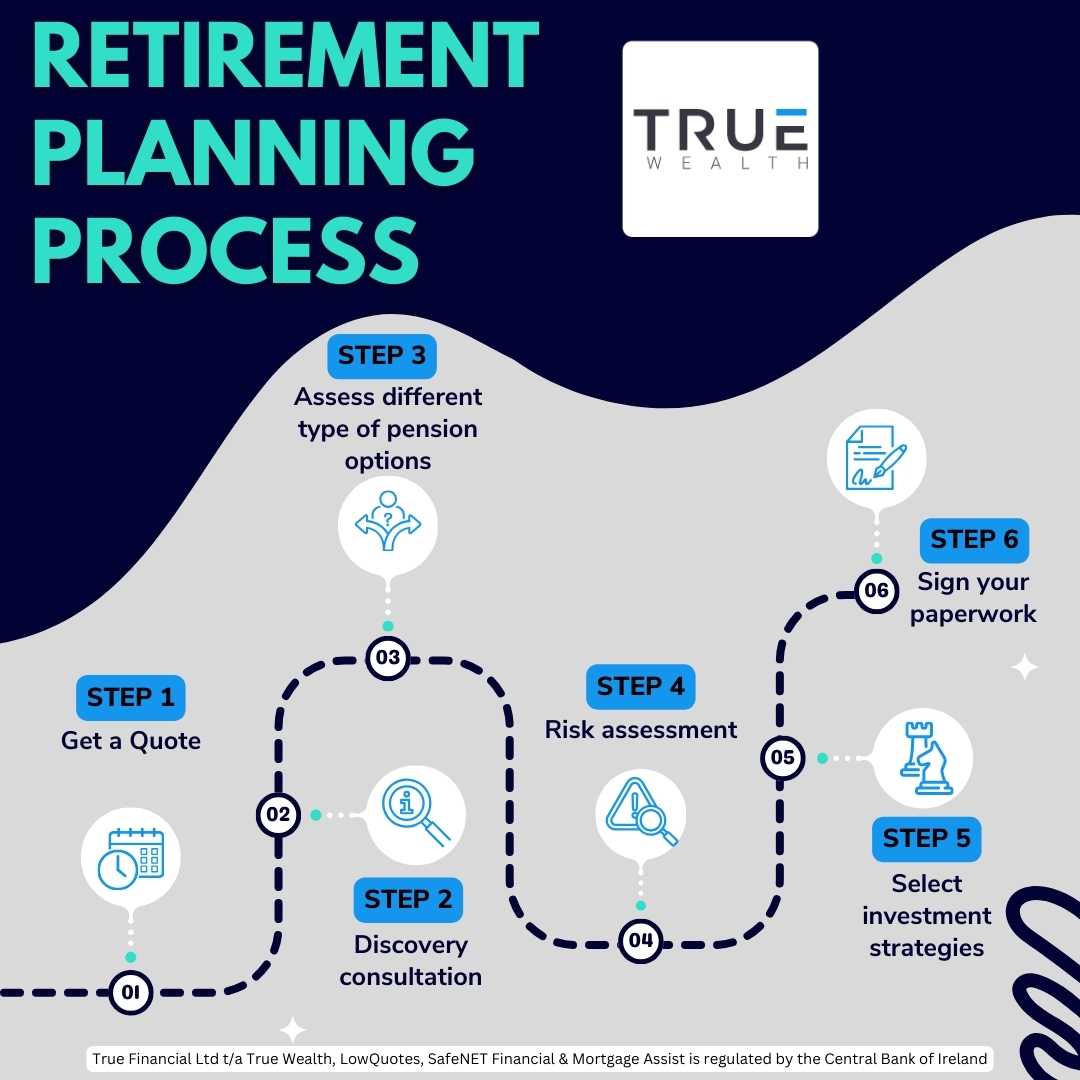

At True Wealth, we understand the importance of effective retirement planning and take pride in guiding our clients through each step of the process.

From the initial consultation to signing the paperwork, our dedicated team of financial advisors is with you every step of the way.

1. Get a quote

The first step in your Retirement Planning journey begins with getting a quote.

You will be asked some quick questions which will help us to pair you with a financial advisor to suit your unique situation.

2. Discovery consultation

During our discovery consultation, we provide you with your quote, and you’ll have the chance to have a one-on-one conversation with your dedicated financial advisor.

Your advisor will invest the time to grasp your unique situation and expectations, setting a solid groundwork for your retirement strategy.

Crafting a custom retirement plan involves a comprehensive fact-finding process. This entails collecting data about your current financial position, your comfort level with risk, your preferred investment options, and the timeline for your retirement.

This step is pivotal in evaluating the appropriateness of various pension options.

3. Assess different types of pension options

Our team will present you with a range of pension options tailored to your specific needs.

We will explain the advantages and disadvantages of each, ensuring you have a clear understanding of your choices.

This comprehensive assessment helps you make an informed decision about your pension plan.

5. Risk Assessment

Understanding your risk tolerance is fundamental to the pension process.

We will work with you to assess your comfort level with different levels of risk.

This information will guide the development of an investment strategy that aligns with your preferences and goals.

6. Select investment strategies

Based on the risk assessment and your long-term objectives, we will recommend investment strategies that maximise your retirement savings.

Whether you prefer a conservative approach, an aggressive strategy, or something in between, our goal is to create a diversified investment portfolio that suits your needs.

7. Sign your paperwork

Once you are satisfied with your retirement plan and investment strategy, it’s time to sign the necessary paperwork to put your retirement plan in action.

Our team will walk you through all documentation, ensuring that you understand each aspect of your pension arrangement.

Your Retirement in Your 40s with True Wealth

True Wealth understands that retirement planning cannot be standardised for everyone.

We work closely with you to develop a personalised strategy that aligns with your unique financial situation, lifestyle, and retirement goals. This tailored approach ensures that your plan is precisely designed to meet your expectations.

Seeking professional advice from True Wealth is an investment in your future. With our knowledge, you can navigate the complexities of retirement planning in Ireland and secure a comfortable retirement.

Don’t limit your retirement to the State Pension; partner with True Wealth for a well-structured and tailored retirement plan.

We are also experts in personal and business protection, savings and investments, pension tracing, personal and business financial planning, mortgages, and wealth extraction.

Get a Retirement and Pension Planning Quote

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down and up.

Warning: If you invest in this product, you will not have any access to your money until you retire.

Warning: If you invest in this product, you may lose some or all of your investment.

Warning: This product may be affected by changes in currency exchange rates.