Are you considering the possibility of gifting money or assets to your family during your lifetime? It’s important to be aware that this can have tax implications for the person receiving the gift. However, you could achieve significant tax savings on behalf of your beneficiary by setting up a specific savings policy.

A Section 73 policy is a financial strategy designed to cover Capital Acquisitions Tax (CAT) liabilities associated with future gifts made during the policyholder’s lifetime.

Capital Acquisitions Tax, commonly referred to as the gift and inheritance tax, applies to all gifts and inheritances received. Individuals are permitted to accept a specified amount of gifts and inheritances throughout their lifetime without triggering this tax. Should the cumulative value received surpass this lifetime exemption limit, the tax is then imposed at a standing rate of 33% (as of April 2024).

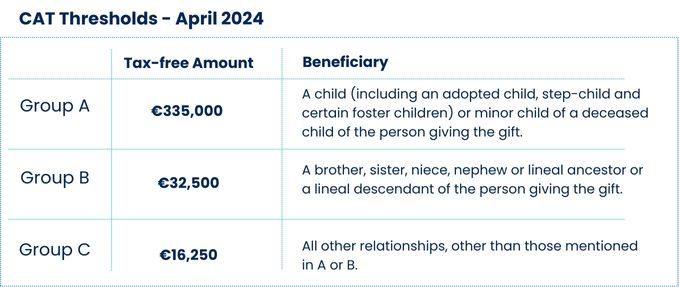

As of April 2024, a parent can gift their child assets up to €335,000 without incurring Capital Acquisitions Tax (CAT).

* CAT only applies to amounts over the relevant group threshold. CAT is charged at 33% on gifts and inheritances.

No matter where you are on life’s journey, the choices you make today will impact your family’s future.

Don’t wait any longer! Get a quote today!

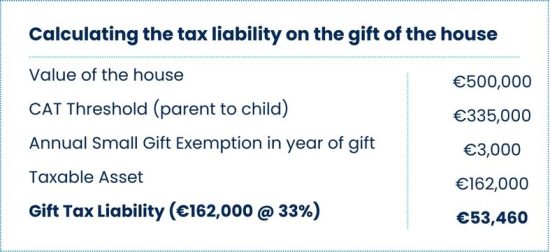

For instance, Jane has a house worth €500,000 and intends to transfer its ownership to her son, Alex. Transferring the property in its entirety would result in a CAT liability of €53,460 for Alex, as it exceeds the tax-free threshold. To address this, Jane decided to implement a Section 73 policy, which is a specific savings plan. She will diligently contribute to this policy for a minimum duration of eight years. When the time comes to gift Alex the house, the money she saved will be used to pay his gift tax bill. The best part is that this saved money won’t be taxed again when it’s used to pay the tax on the house gift.

Notably, these funds are exempt from CAT when specifically used to satisfy the Revenue’s gift tax obligations; they are not subject to capital gains tax (CAT). This strategic approach enables Jane to manage the tax implications efficiently while facilitating the smooth transfer of her assets to Alex.

Please note that the foregoing scenario is provided only for illustrative purposes and should not be considered financial advice. Every individual’s financial situation is unique, so we highly recommend that you consult with one of our experienced financial advisors, who can offer tailored guidance and strategies that align with your specific circumstances.

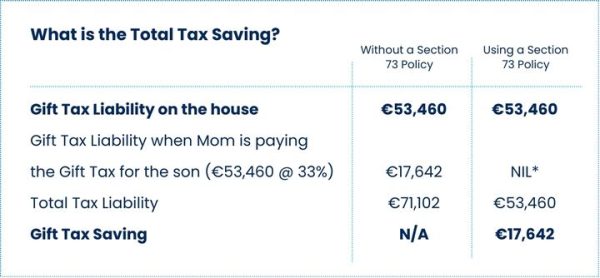

If Jane funds the Gift Tax Liability on the house using a Section 73 Policy, it should ensure that it does not give Alex any further tax liability.

*If the Gift Tax Liability on the house is paid for with money from the Section 73 Policy within one year of the gift, then this does not give rise to an additional Tax Liability. In This example, we assume Alex received no previous gifts from his parents, and there were no Capital Gain Taxes (CGT) available to claim as a credit in the CAT Calculation.

Secure your family’s financial future by setting up a Section 73 policy today—contact us to learn how you can efficiently manage gift tax liabilities.

Tax Efficiency: A Section 73 Policy stands out for its tax-free investment growth feature. This becomes particularly advantageous when using the funds from your Section 73 policy to cover a tax obligation tied to a gift.

The amount drawn from the policy for this specific purpose does not attract Capital Acquisitions Tax (CAT), providing a financial edge by preserving the full value of the savings for the intended use.

Estate Planning: It serves as an estate planning tool, allowing individuals to allocate funds for their beneficiaries in a tax-efficient manner, ensuring financial stability for future generations.

Flexible Contributions: Contributions to a Section 73 policy can be adjusted over time, providing savers with the flexibility to increase or decrease their investment based on their financial situation.

Note that your premium cannot increase or decrease by more than 50% within any given eight-year period.

Receive expert support securing the best insurance and protection policies here at True Wealth. Taking the first step towards a worry-free future is reaching out to us for a consultation today.

The exit tax is levied on the profit generated within the savings plan. This tax is applied at eight-year intervals or upon any full or partial withdrawals made during the eight-year period.

Non-compliance with Revenue’s qualifying criteria means the policy will no longer be recognised as approved by Revenue, disqualifying you from Section 73 benefits. Transferring the proceeds from a policy that has lost its eligibility for Section 73 relief will result in an increased gift tax liability for the beneficiary.

Yes, it is possible to simultaneously benefit from both Section 73 and Section 72 policies under certain conditions.

A plan to qualify for inheritance tax relief (Section 72) must include life insurance coverage that is at least eight times the annual premium. A unit-linked savings component must be featured to be eligible for gift tax relief (Section 73).

Income, Life, Mortgage, Health, Serious Illness Protection

Freephone (1800) 808-808

Maximise your retirement potential and achieve your financial goals with a tax-efficient pension review. Schedule your consultation today with our award-winning advisors and enjoy the benefits of a well-planned financial future.

Make informed decisions. Explore our articles and stay up-to-date.

Subscribe to our YouTube Channel and explore our insights and tips, empowering you to make informed decisions that will not only protect your future and loved ones, while also ensuring you achieve all your financial goals.

At True Wealth, we believe everyone deserves access to expert financial advice, regardless of their current wealth or financial situation. If you have a passion for connecting with people and aspire to thrive in a culture built on trust, integrity, dedication, and excellence, this could be the perfect fit. Let’s grow together!