Tax-Efficient Planning: Retirement Relief in Business Asset Disposals

Table of Contents

Whether you decide to sell your business or pass on its legacy, understanding your options for tax efficiency is paramount.

As a business owner, the decision to transition your company involves more than just the transfer of ownership; it encompasses the financial implications that can significantly impact your hard-earned assets.

We recommend delving into our article, Estate and Succession Planning for Business Owners, to safeguard your legacy and facilitate the smooth transition of assets to future generations.

What is retirement relief?

Retirement relief, a form of Capital Gains Tax (CGT) relief, is a financial benefit granted to individuals when they sell all or a portion of the ‘qualifying assets’ associated with their business.

These assets may include various elements such as family firm or business assets used in a trade (like premises, goodwill, or farming land) or shares in a family-owned company.

Retirement relief has the potential to entirely eliminate your CGT tax liability from the sale of your assets, provided certain requirements are met.

In simple terms, with retirement relief, you can have this tax 100% reduced, so you do not have to pay any CGT.

How much can you save with capital gains tax retirement relief?

By claiming capital gains tax retirement relief, you could potentially save a significant amount.

Under typical circumstances, selling a substantial business asset would normally incur a 33% capital gains tax liability.

However, with retirement relief, you might be eligible for a 0% CGT obligation, subject to certain limits and depending on the age of the person selling the asset.

Example:

Imagine a business owner, John, who is 56 years old and decides to sell a significant business asset, with a market value of €700,000.

Without retirement relief, John would be liable for a 33% capital gains tax on the profit from the sale, which is calculated as follows:

Capital Gain = Selling Price − Purchase Price

Let’s assume John originally purchased the property for €350,000. Therefore, the capital gain would be €700,000 – €350,000 = €350,000.

Now, without retirement relief, the capital gains tax payable would be 33% of €350,000, resulting in a tax liability of €115,500.

In this case, if John meets the criteria for full retirement relief, he can save the entire €115,500 that would have otherwise been paid in capital gains tax.

This represents a substantial saving and a clear incentive if you’re considering selling business assets.

It’s essential to consult one of our financial advisors at True Wealth to ensure eligibility and understand the specific requirements for capital gains tax retirement relief in your jurisdiction, as regulations may vary.

Get a Tax Efficient Planning Quote

To be eligible for retirement relief, do I have to retire?

No, the term ‘retirement’ doesn’t imply that you must retire to qualify for the relief.

You can, in reality, remain employed with the company in any role even after selling the asset and still benefit from this tax relief.

What are the qualifying conditions for retirement relief?

Here is an overview of some of the requirements:

- The transfer must be carried out by an individual and not by a company.

- The individual needs to be at least 55 years old at the time of the transfer.

- The disposal must involve qualifying assets, which include business assets, shares, etc.

- These qualifying assets must be held for a minimum of 10 years prior to their disposal.

- In the case of disposal involving family company shares, the individual must have served as a director for a minimum of 10 years leading up to the transfer.

If you are younger than 55, you might qualify for retirement relief where you:

- are unable to continue farming or your profession due to ill health (you will need to provide medical evidence of the illness.)

- reach the age of 55 within 12 months of the disposal.

For more information, visit the Revenue website.

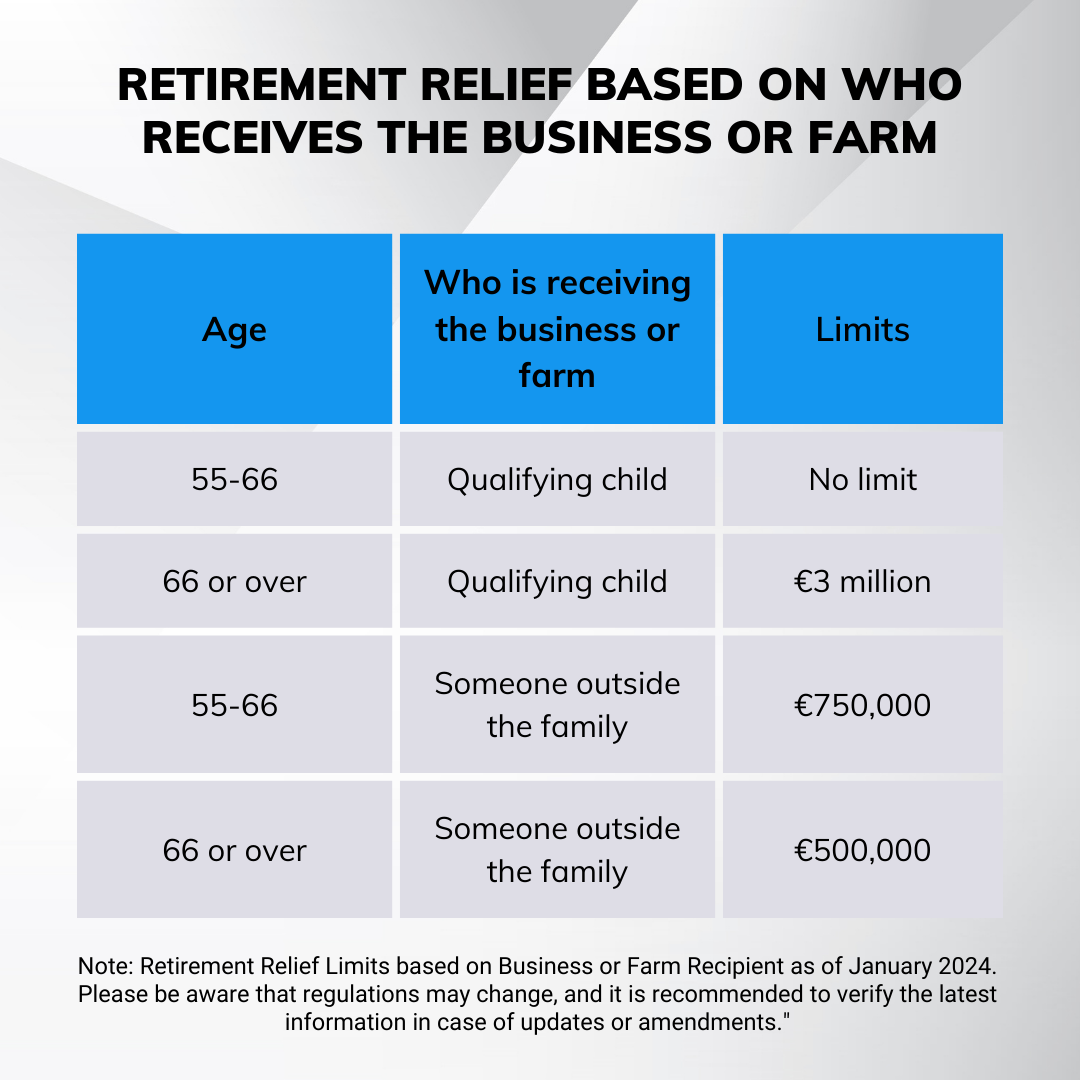

Types of Retirement Relief Based on Who Receives the Business or Farm

There are two types of Retirement Relief, depending on whether you transfer your business or farm to:

Your child, which includes:

- Your son or daughter

- Your stepchild or child of a civil partner

- A child adopted under, or recognised as adopted under, the Adoption Act 2010

- A child of a deceased child

- Your niece or nephew who has worked full time in the business or farm for at least five years

- A foster child whom you have supported for at least five years before they turned 18 (supported by testimony from more than one witness).

If you’re aged 55 to 65, you can claim full tax relief when transferring ‘qualifying assets’ to your children.

If you’re aged 66 or older at the time of disposal, you will experience relief limitations, capped at €3 million.

That’s why it is essential to transfer assets at the right time if you intend to do so. After you turn 66, you have to consider the relevant thresholds.

Someone outside the family

When considering retirement relief for someone outside the family, specific limits are applicable:

- Between the ages of 55 and 66, there is a limit of €750,000.

- For individuals aged 66 or older, the limit is €500,000.

Get a Tax Efficient Planning Quote

Disposal to Your child

If you are between 55 and 66 at the time of transferring assets to your child, you are eligible for full Capital Gains Tax (CGT) retirement relief, provided all other qualifying conditions are satisfied.

For individuals aged 66 or older during the disposal, relief is limited to proceeds of up to €3 million.

This emphasises how crucial it is to choose the perfect time when considering transferring assets to your children.

Be cautious about a potential clawback: if your child sells the asset within six years, Revenue will withdraw the relief. In this case, your child must pay Capital Gains Tax (CGT) on both the original transfer by you and their subsequent disposal.

It’s important to understand that effective estate planning is essential to minimising potential inheritance tax obligations. Read our article, Estate and succession planning for business owners.

Disposal to someone outside your family.

Full Relief

You are eligible for complete relief if the market value at the time of disposal doesn’t surpass the specified limit:

- €750,000 for disposals if you are under 66.

- €500,000 for disposals if you are 66 or older.

If the market value exceed the limit, marginal relief might come into play, capping the Capital Gains Tax (CGT) at half the difference between the market value and the threshold.

Be cautious about the lifetime limits of €750,000 and €500,000; exceeding these thresholds triggers relief withdrawal. In such cases, you become responsible for CGT gains on all disposals.

Marginal Relief

Marginal relief might be applicable to gains surpassing the thresholds, capping Capital Gains Tax (CGT) at half the difference between:

– the sale price or market value

and

– the threshold.

Example:

Sarah, who is 59 years old, sells her family business for €850,000.

In this scenario, full relief wouldn’t be applicable as the full relief limit is €750,000.

Consequently, the surplus would be €100,000.

If Sarah applies for marginal relief, the tax liability will be the selling amount of €850,000 minus the €750,000, resulting in €100,000.

Thus, the resulting Capital Gains Tax (CGT) would amount to half of the surplus, which is €50,000.

This shows that substantial savings on CGT tax obligations can be achieved through the use of retirement relief, whether it is in full or marginal.

Get a Tax Efficient Planning Quote with True Wealth

Take the first step towards optimising your business’s financial future by securing a Tax-Efficient planning quote with True Wealth.

With True Wealth, you can expect comprehensive insights into potential tax benefits and savings through strategic planning.

Let us navigate the complexities of tax planning for your business, ensuring that every aspect is aligned for maximum financial efficiency.

Additionally, read our article, Corporate Tax Planning: 6 Things Irish Business Owners Should Be Doing Now.

Gain in-depth knowledge by exploring our article, A Guide for Business Owners on Protecting, Extracting, and Growing Wealth in Ireland.

We at True Wealth are experts in personal and business financial planning, retirement and pension planning, pension tracing, savings and investments, protection, mortgages, and wealth management.

Get a Tax Efficient Planning Quote

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Annual Pension Statement: What You Need to Know