What is an Approved Retirement Fund (ARF)?

Table of Contents

One of the most important decisions you have to make when you retire is how to handle your income and financial needs.

Even if you’re no longer working, you still have regular expenses like bills and household costs, as well as other financial responsibilities to think about.

When it comes to planning for retirement, there are various options and vehicles available to help secure your financial future.

One such option that plays a significant role in retirement planning is the Approved Retirement Fund (ARF).

What are my options at retirement?

You will have various options when you retire, and subject to specific guidelines from Revenue, you can potentially combine these options.

The range of choices accessible to you upon retirement is contingent upon your type of pension.

There are four main options available to you:

- Take a tax-free retirement lump sum (subject to a lifetime limit of €200,000)

- Take a taxed retirement lump sum

- Invest in an Approved Retirement Fund (ARF)

- Buy an Annuity

What is an Approved Retirement Fund (ARF)?

An Approved Retirement Fund, often referred to as ARF, allows you to keep your retirement savings invested even after you retire.

It gives you freedom to withdraw money whenever you want.

As the savings are still invested, their worth can increase or decrease.

Why Choose an ARF for Your Retirement?

There are several advantages to choosing an ARF for your retirement planning:

Investment Flexibility

ARFs offer a wide range of investment options, including equities, bonds, property, and more. This flexibility allows you to tailor your investments to your financial goals.

Income Control

You have control over your retirement income and can make withdrawals as needed. This flexibility can be particularly beneficial for individuals who want to manage their retirement finances according to their lifestyle and changing needs.

Estate Planning

ARFs can be passed on to your beneficiaries after your passing, offering an avenue for wealth transfer and inheritance planning.

ARF Considerations

While ARFs offer flexibility and control, they also come with certain considerations and risks:

Investment Risk

The performance of your ARF is subject to market fluctuations. It’s essential to diversify your investments to manage risk effectively.

Taxation

ARF withdrawals are taxable, and you need to be aware of the tax implications to avoid unexpected financial obligations.

Financial Planning

Proper financial planning is crucial to ensure your ARF provides for your retirement needs.

Get a Retirement and Pension Planning Quote

How Does an ARF Work?

ARFs are typically used when you have already reached retirement age, and they often come into play when a pension scheme reaches maturity.

Transfer of Pension Funds

At retirement, instead of purchasing an annuity, you can transfer your pension fund into an ARF.

Investment Options

An ARF provides access to various investment funds, consisting of stocks, bonds, real estate, and cash.

When deciding on your investment fund strategy, it’s crucial to take into account your risk tolerance and your investment objectives.

After retirement, you might have two or three more decades to live. Therefore, it’s crucial to manage your ARF in a way that allows it to continue growing.

Working with one of our financial advisors at True Wealth is essential to ensure that your investment decisions align with your retirement goals.

Withdrawals

You can withdraw money from your ARF as needed either regularly or the entire fund at once.

Regular Income

You have flexibility in how you receive income from your ARF, with options for monthly, quarterly, semi-annual, or annual payments.

Your regular income can either be a set monetary sum (with a minimum of €1,200 annually) or a percentage of your fund’s value (with a minimum of 1% annually).

The income you receive is not guaranteed and it depends on the performance of your investments.

Opting for a regular income may reduce the overall worth of your ARF, particularly in cases of inadequate investment returns or if you select a substantial regular income rate.

The higher the level of the regular income you opt for, the more likely it is that your ARF will run out during your lifetime.

Once your ARF is used up, no further income will be provided.

Your ARF might be ended if, after receiving a regular income payment, its value falls below €1,000.

Partial Withdraws

You have the flexibility to make partial withdrawals from your ARF at your discretion. The smallest amount you can withdraw is €350, provided that there’s still a minimum of €1,000 left in your ARF.

If, after making a partial withdrawal, your ARF’s value drops below €1,000, your ARF could be ended.

Minimum Deemed Withdraw

The minimum deemed withdrawal from your ARF is a required annual deduction of a specified amount for tax purposes, even if you decide not to take regular income or if the income you take is less than this minimum deemed withdrawal amount.

You’ll start receiving the minimum deemed withdrawal percentage from your ARF when you reach age 61 (or 60 if your birthday is on January 1).

At this point, tax is applicable to a minimum deemed withdrawal of 4% of your ARF’s value.

This percentage increases to 5% when you turn 71 (or 70 if your birthday is on January 1).

Tax Considerations

ARF withdrawals are subject to income tax, and there are annual minimum withdrawal requirements.

The income received from an ARF might be subject to taxation at the rate that applies to your highest income (currently 20% or 40%)

Additionally, if you are liable for this, a 4% Pay Related Social Insurance (PRSI) and the Universal Social Charge (USC), which can go up to 8%, may be applicable, depending on your income and age.

It’s important to understand the tax implications and the rules governing ARFs to make informed decisions.

Feel free to reach out to one of our financial advisor at True Wealth. We can help you navigate the complexities of ARF taxation.

Eligibility for an ARF

You need to have a pre-retirement product to qualify for an ARF. You can’t simply withdraw a lump sum from your bank account and start an ARF.

It’s crucial to understand that the eligibility criteria might differ based on your particular pension plan and the company managing it, so make sure to get in touch with us at True Wealth and we’ll be happy to provide you with guidance and support.

The eligible pension arrangements are:

- Personal Retirement Savings Accounts (PRSAs)

- Personal Pension Plans

- Employees who are part of an Occupational Pension Scheme can receive a retirement lump sum equal to 25% of their fund’s value, provided that the scheme’s rules permit this 25% retirement lump sum option.

- Existing ARF

- Additional Voluntary Contributions (AVCs) – some conditions apply.

Get a Retirement and Pension Planning Quote

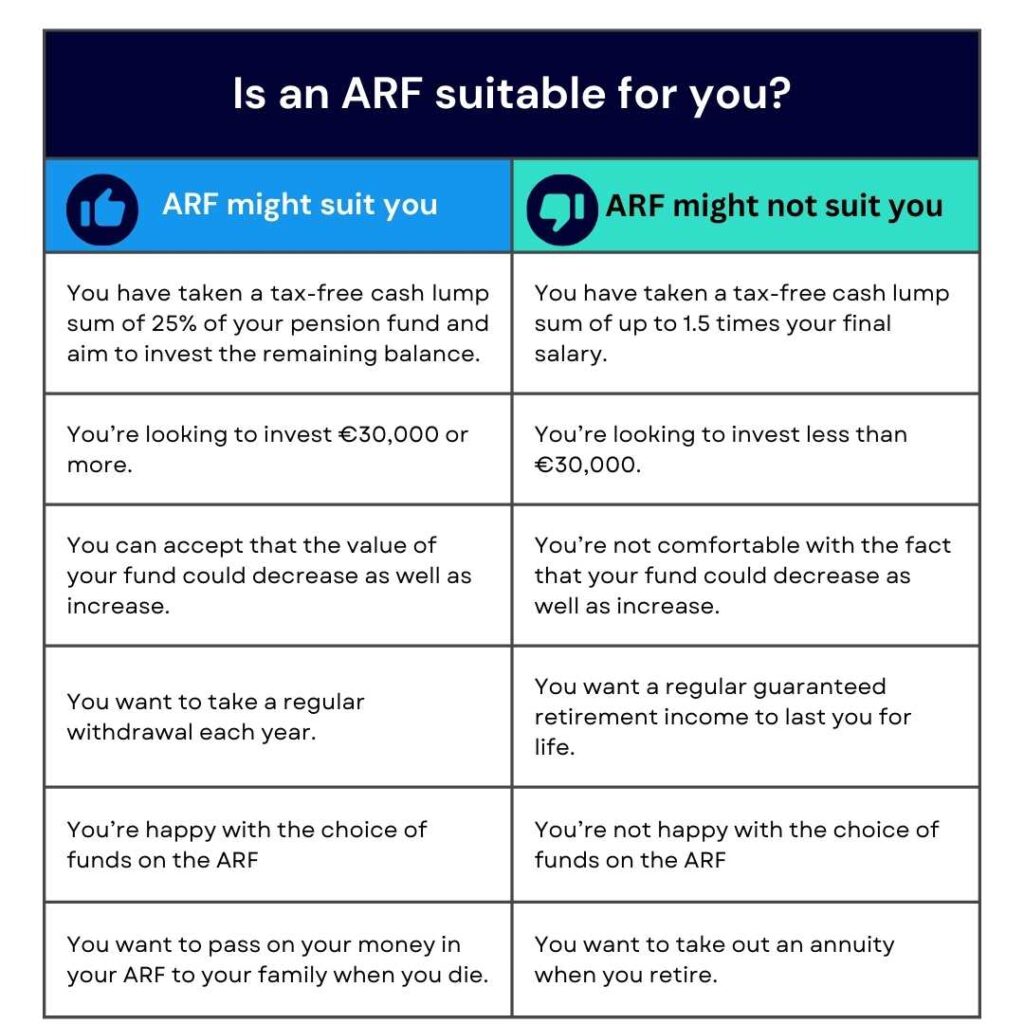

Is an ARF suitable for you?

Here are the reasons to consider an ARF:

What happens with my ARF if I die?

Payment on death

One of the main advantages of ARFs is that any money remaining in your ARF after your death can be left to your next of kin.

However, you need to specify in your Will that you want your ARF left to your spouse or other family members. Otherwise, your ARF will slide into the residue of your estate and it may not be distributed as you would like it to be.

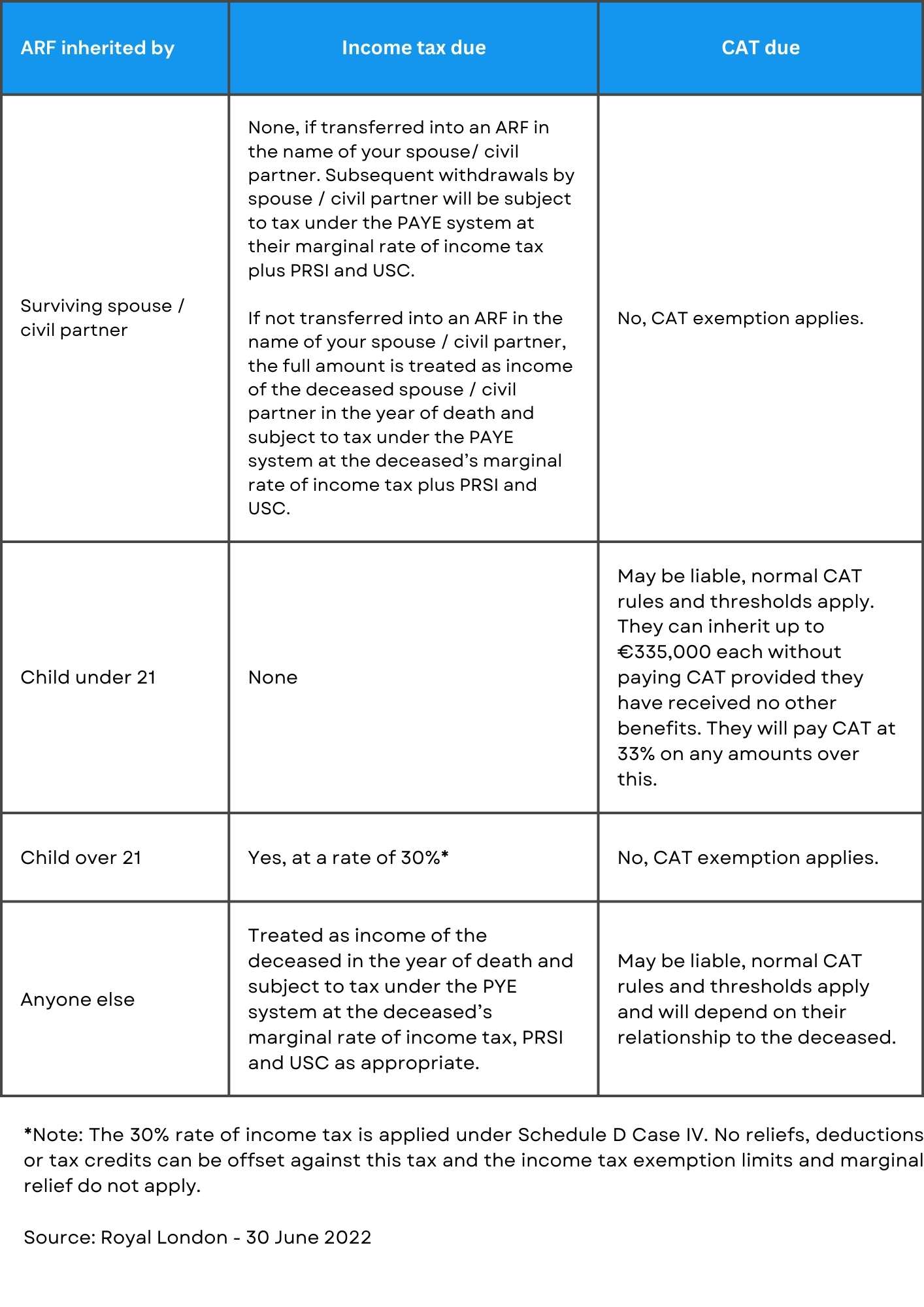

How is your ARF taxed on death?

If your ARF is moved into an ARF under your spouse or civil partner’s name, there are presently no income tax or Capital Acquisitions Tax (CAT) obligations.

However, if you leave your ARF to another individual, they might be required to pay income tax and/or CAT, depending on their identity and, in certain cases, their age. If any income tax is due, it must be deducted before we release the ARF proceeds to your estate.

When planning your estate, it’s important to find ways to lower the inheritance taxes for your intended beneficiaries, as the tax rates can vary depending on who inherits the money.

Summary of the tax rules after your death

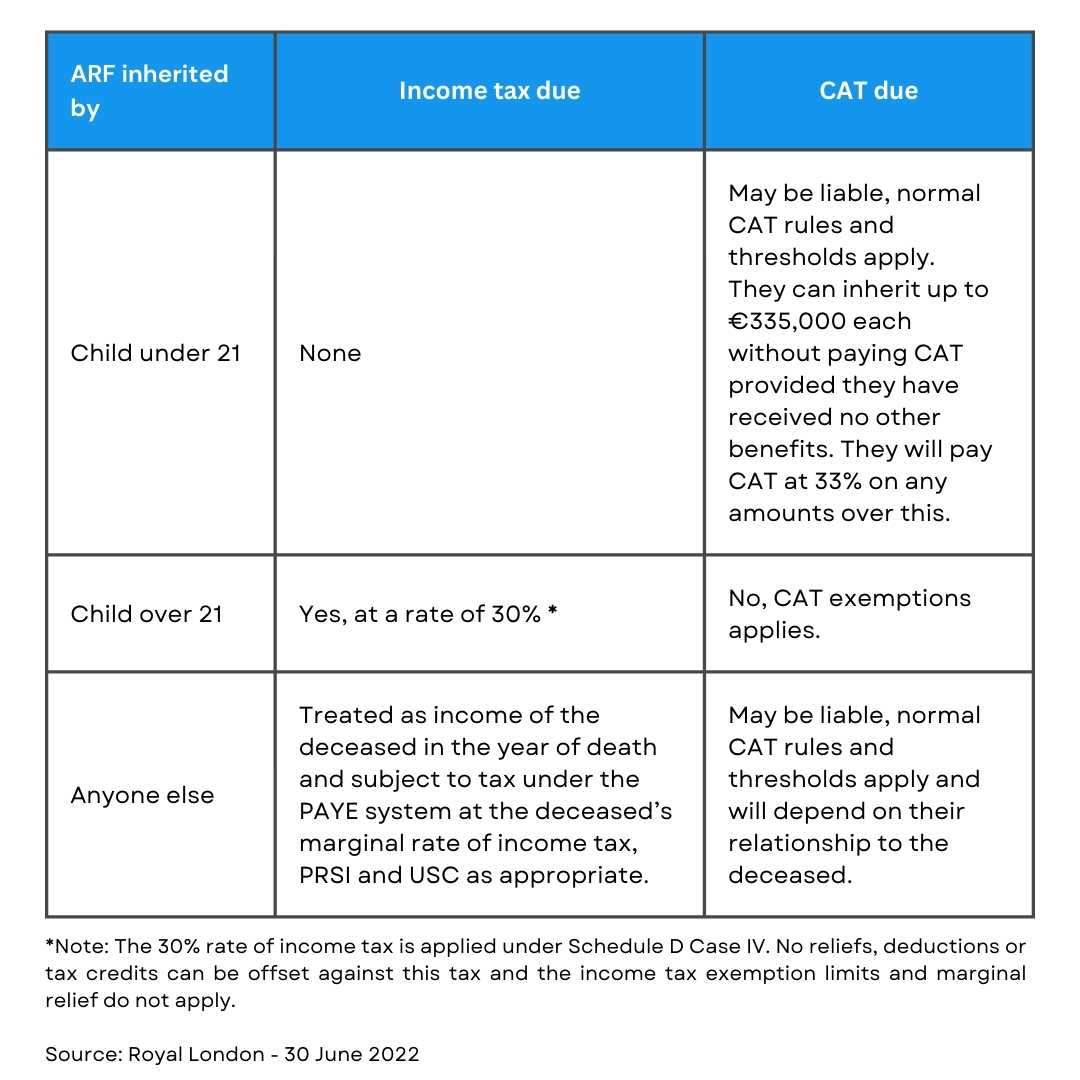

Summary of the tax rules after the death of your surviving spouse/civil partner

If on your death, your ARF is transferred into an ARF in your spouse or civil partner’s name, the funds will be taxed on their death as follows:

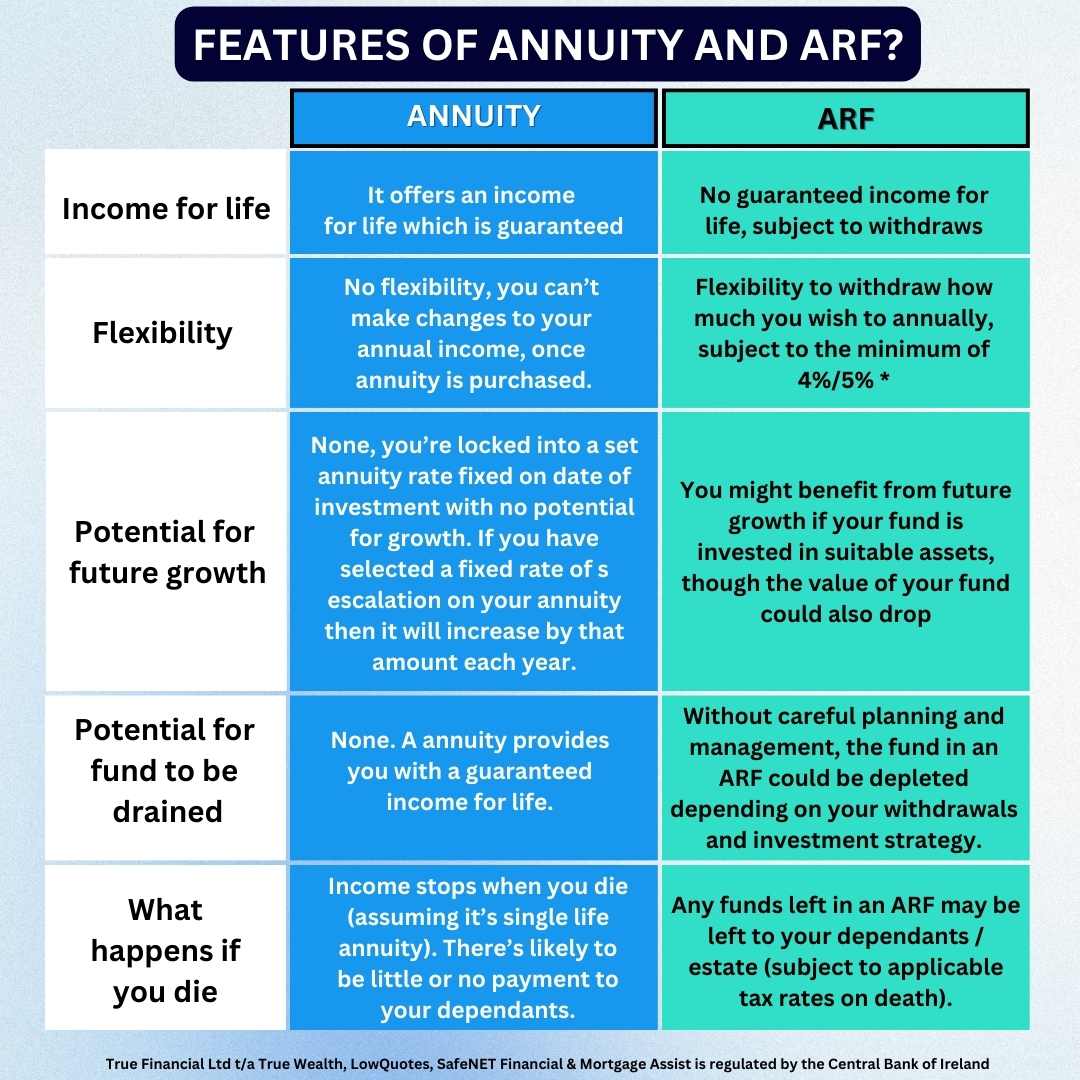

Which one is the best? Annuity or ARF?

The main difference is that with an annuity, the payment stops when the holder passes away, while with an ARF, the surviving spouse can inherit the money without paying taxes.

So, the decision is about whether you want a regular income or want to preserve the wealth for the future.

* Note:

- In the year an ARF policyholder turns 61, it’s compulsory to withdraw a minimum of 4% of the fund.

- In the year they turn 71 this increases to 5% per annum.

- If the ARF is greater than €2,000,000 then the minimum withdrawal is 6%.

How do you set up an ARF?

Setting up an ARF involves several steps, but it’s a straightforward process as we provide guidance at every stage.

- First, you must meet the eligibility criteria set by your pension plan and provider. Once you qualify, you’ll need to move your pension savings into an ARF account. This transfer can be done through your pension provider or a financial institution offering ARF accounts.

- Afterward, you can decide on how to invest your funds and manage your withdrawals. It’s crucial to collaborate with your dedicated financial advisor at True Wealth to make well-informed choices and maximise your retirement savings.

- To set up an Approved Retirement Fund (ARF), you’ll typically need to provide the following documents:

- Proof of identity (such as a Passport or Driver’s License).

- Bank details, including IBAN and Bank Identifier Code (BIC) for ARF withdrawals.

- Information about the source of your investment – where the funds for the ARF are originating from, which must be a pension product along with the policy, proposal, and plan number of your pre-retirement product (e.g., PRSA, PRB).

- Your attitude toward risk – this information will help in selecting suitable funds for your ARF.

Set up your ARF with True Wealth

Embark on your journey to establish your ARF with True Wealth.

Our experienced team specialises in retirement planning, and we are here to assist you every step of the way, making the process simple and ensuring your financial future is in capable hands.

We are also experts in personal and business protection, savings and investments, pension tracing, personal and business financial planning, mortgages, and wealth extraction.

Get in touch with us today to kickstart your ARF setup and secure your retirement plans.

Get a Retirement and Pension Planning Quote

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Pension Annuities: Retirement Income For Your Whole Life