Is Auto-Enrolment the Best Option for Your Business?

Table of Contents

After numerous delays, the much-anticipated auto-enrolment pension scheme is expected to be launched in 2025. This scheme will automatically enrol all eligible employees into a pension plan, making it essential for business owners like you to understand its impact.

However, it is crucial to thoroughly understand the rules and details to determine if this is the best solution for your business or if an occupational pension scheme might be a better option for you and your employees.

What is Auto-Enrollment?

Around 750,000 workers in Ireland lack a private pension, meaning nearly a third of the workforce will depend solely on the State pension in retirement.

With the full State pension in 2024 being €277.30 per week, these workers could experience a significant reduction in their standard of living upon retirement.

Auto-enrollment is a straightforward way to help employees save for retirement. Instead of signing up on their own, eligible employees are automatically added to a pension plan.

This setup makes saving for the future easier and more common because it starts everyone off by default. Employees who don’t want to be part of the pension plan can opt out.

Rules and Eligibility for Auto-Enrolment in Ireland

The auto-enrolment pension scheme in Ireland, expected to begin in January 2025, aims to ensure that more workers save for retirement. Here are the key rules and eligibility criteria for the scheme:

Eligibility Criteria for Employees

Age: Employees aged between 23 and 60 years old.

Income: Employees earning €20,000 or more per year across all their employments.

Current Pension Status: Employees who are not already enrolled in an occupational pension scheme will be automatically enrolled. Employees who are already contributing to a workplace pension will not be automatically enrolled in the new system.

Contribution Rates

Employee Contribution: Employees will start contributing 1.5% of their gross salary during their first three years. From the third year onward, contributions will increase to 3%. By the sixth year, they will rise to 4.5%, and by the tenth year, they will reach the maximum of 6%.

For example, someone earning €45,000 a year (which is about the national average wage) would start by contributing €675 in the first year, which breaks down to roughly €13 a week.

By the time they reach the tenth year, their annual contribution would be €2,700, or about €52 a week.

Employer Contribution: Employers are required to match the employee’s contributions at the same rate.

State Top-Up: The government will contribute an additional €1 for every €3 saved by the employee. This means that for every €3 saved by an employee, a total of €7 will be invested into their pension fund (including the employer’s and State’s contributions).

Opt-Out Provision

Employees will be automatically enrolled but have the option to opt-out after six months. If they opt out, their contributions will be refunded.

If the employee opt-out in month 7 or 8 after the rate changes, they’ll get a refund based on the difference between the old and new contribution rates over the past 6 months.

If either of the employees leave the plan or pause contributions, they’ll automatically be re-enrolled after two years if they’re still eligible. However, they won’t be re-enrolled if they have another pension plan.

They can rejoin the plan anytime within those two years.

Fund Options

Employees can choose from three retirement savings funds with different risk/return profiles. Those who do not choose a fund will be enrolled in a default fund with a life-cycle investment profile.

Phased Implementation

The introduction of auto-enrolment will be phased in gradually over a decade, starting with a contribution rate of 1.5% and increasing to 6% by year ten. This allows time for both employers and employees to adjust to the new system.

Get a Retirement and Pension Planning Quote

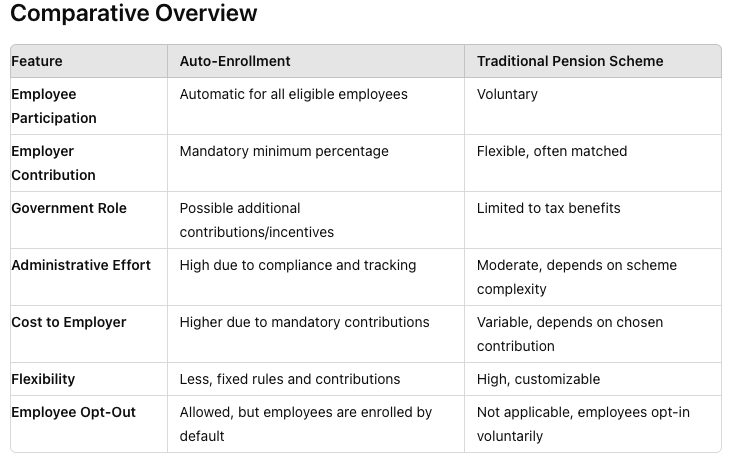

What’s the difference between auto-enrolment and private pension schemes?

Auto-enrolment automatically enrols all eligible employees in a pension scheme, requiring both employers and employees to contribute a set minimum percentage of the employee’s salary.

Employees can opt out if they choose, but they are enrolled by default. The government may also offer additional contributions or incentives to boost employee savings.

Private pension schemes are voluntary, with employees choosing to join and contribute. Contributions are flexible and may be matched by employers. These schemes can be tailored to fit the business’s and its employees’ needs.

As a business owner, understanding these differences will help you decide which pension scheme aligns best with your business goals and employee needs.

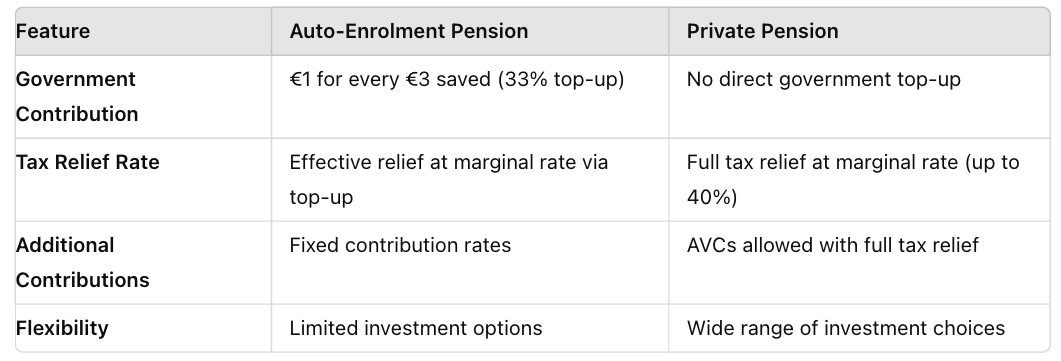

How Does Tax Relief Differ Between Auto-Enrolment and Private Pensions?

When it comes to retirement savings, understanding the differences in tax relief between auto-enrolment and private pensions is crucial. Both systems offer tax advantages, but the specifics can vary significantly.

Auto-Enrolment Pension Tax Relief

Government Top-Up: In the auto-enrolment scheme, the Irish government contributes €1 for every €3 saved by the employee. This translates to a 33% state top-up on contributions (Smart Financial) (Mason Hayes Curran).

Employee Contributions: Contributions are made from gross salary before tax is applied, which means employees effectively get tax relief at their marginal rate. However, the direct government top-up is a fixed rate.

Private Pension Tax Relief

Marginal Tax Rate Relief: Contributions to private pensions, such as Personal Retirement Savings Accounts (PRSAs) or occupational pension schemes, qualify for tax relief at the individual’s highest marginal tax rate. This means if you pay tax at 40%, you get 40% tax relief on your contributions.

Additional Voluntary Contributions (AVCs): Private pensions allow for AVCs, which can also benefit from tax relief at the individual’s marginal rate. This offers more flexibility for higher earners to maximise their tax benefits.

More Flexibility: Private pensions often offer more flexibility regarding investment choices and contribution levels, potentially allowing for higher returns or tailored retirement strategies.

Summary of Tax Relief Comparison

Both auto-enrolment and private pensions offer significant tax advantages, but they cater to different needs and income levels. Auto-enrolment provides a straightforward, accessible way to save for retirement with a 33% government top-up, making it particularly beneficial for lower to middle-income earners.

On the other hand, private pensions offer more flexibility and higher potential tax relief at the marginal rate, which can be more advantageous for higher earners who want to maximise their retirement savings.

Auto-enrolment offers simplicity and benefits for lower to middle-income employees with government top-ups.

Private pensions, ideal for higher earners, provide flexibility and higher tax relief.

Business owners should encourage auto-enrolment for its simplicity and broad employee coverage, while recommending private pensions for higher-income employees seeking control and tax savings.

Get a Retirement and Pension Planning Quote

Why Private Pension Scheme Might Be a Better Option for Your Company and Employees Than Auto Enrolment

While auto-enrolment provides a basic level of retirement savings, it often comes with generic investment options and contribution rates that may not suit all employees.

On the other hand, an occupational pension scheme, for example, allows the company to negotiate better terms, offer higher employer contributions, and select investment options that align with the company’s values and the financial goals of its employees.

This personalised approach can enhance employee satisfaction and retention, ensuring that the pension plan is a valuable and appreciated benefit rather than a mere compliance measure.

Customisation and Flexibility

Private Pensions: Allow customisation over auto-enrolment schemes, letting companies tailor private pension plans to meet employees’ specific needs, including investment options that match their risk tolerance and retirement goals.

Auto Enrolment: Typically follows a one-size-fits-all approach. Investment choices and contribution levels are often standardised, which provides less flexibility for individual employees.

Improved Employee Engagement and Satisfaction

Private Pensions: Personalised pension plans make employees feel valued, boosting morale, loyalty, and job satisfaction. Tailored financial advice demonstrates a commitment to their long-term financial well-being.

Auto Enrolment: While it ensures that employees are saving for retirement, it might not engage them on a personal level. The lack of customisation can lead to lower employee engagement with their pension plan.

Competitive Advantage in Recruitment

Private Pensions: Providing a private pension can set your company apart in the competitive job market. High-quality candidates often look for comprehensive benefits packages, and a superior pension plan can be a deciding factor. This can be particularly advantageous for attracting senior or highly skilled professionals who will likely value enhanced retirement benefits.

Auto Enrolment: Since it is a standard offering across many businesses, it does not provide a significant differentiator when competing for top talent.

Tax Efficiency and Cost Management

Private Pensions: Can be structured in a tax-efficient manner, benefiting both the company and its employees. Employers may have more control over the contributions and timing, allowing for better cash flow management and potential tax advantages.

Auto Enrolment: While still offering tax benefits, the mandatory nature and predefined contribution rates may limit the financial flexibility for both employers and employees.

Benefits of Occupational Pension Scheme for Employers and Employees

Occupational pension schemes offer numerous benefits for both employers and employees, making them a vital component of a comprehensive employee benefits package.

For employers, providing an occupational pension scheme enhances their ability to attract and retain top talent. Additionally, contributions to these schemes can be tax-efficient, offering potential financial savings for businesses.

Employees, on the other hand, gain a structured and reliable means of saving for retirement. Occupational pension schemes often include employer contributions, which significantly boost the total savings compared to individual efforts alone. These schemes also provide tax advantages, as contributions are typically made before tax is deducted, increasing the overall value of the retirement savings.

Read our article here for more insights into the benefits of occupational pension schemes.

Get a Retirement and Pension Planning Quote

The Importance of Retirement Planning

Retirement planning ensures financial security and peace of mind in your later years. It involves more than just saving money; it requires understanding various types of pensions, tax relief options, and how pensions operate.

Our comprehensive retirement planning guide covers these aspects in detail, including insights on lost pensions and transferring pensions.

Additionally, we provide strategies tailored to different stages of your life, ensuring you’re well-prepared for retirement.

We also discuss post-retirement strategies, helping you make the most of your savings and enjoy a comfortable, worry-free retirement.

Dive into our guide to navigate your retirement journey with confidence and clarity.

The ultimate Retirement Planning Guide.

Planning for retirement is a significant life milestone. Whether you’re just starting to think about retirement or are already well into your retirement journey, this guide aims to empower you to make informed decisions and create a retirement plan that aligns with your unique financial goals and expectations.

After you download your guide, one of our expert mortgage advisors will be in touch shortly to provide you with guidance and further relevant information including typical repayments, qualification amounts and mortgage requirements.

Get a Retirement Planning and Pensions Quote with True Wealth

Whether you need to understand auto-enrolment requirements or set up an occupational pension scheme for your employees, we are here to guide you every step of the way.

Let us help you create a robust pension plan that supports your workforce and strengthens your business’s future.

We provide various financial services, such as mortgages, serious illness cover, pensions, life insurance, financial planning, health insurance, and savings & investments.

Get a Retirement and Pension Planning Quote

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.