Retirement Planning in Your 30s

Table of Contents

As you reach your 30s, you may already have an existing pension plan or be considering starting one. The good news is that starting your pension savings at this stage allows you to take advantage of the tax benefits and compound interest for over 30 years.

Additionally, starting your pension early ensures that market fluctuations have a reduced impact over an extended timeframe.

When is the best time to start a Pension?

The sooner you start your pension, the more advantageous it is, but it’s never too late to start.

Starting your pension early has two main advantages: you have more time to grow your pension savings, and you can usually take bigger investment risks in the early stages of your pension building phase because of that plus the compound effect of interest building on top of interest, and it’s completely tax-free.

Why should I start a private pension?

Setting up your private pension is important for several reasons. You need to make sure you will have a comfortable retirement or maintain your current lifestyle.

Even though the State Pension offers valuable financial support for retirees, it might not be enough to maintain your standard of living or cover all your financial needs during retirement.

Consider the bills and expenses you’re likely to have during retirement and determine if the State Pension, which is €265 per week (as of January 2023), will be enough to meet your financial requirements.

If you think the State Pension will not be enough, having a private pension becomes crucial to guarantee your financial well-being in retirement.

Explore our article that delves into 9 Reasons to Have a Private Pension in Ireland. By reading our article, you’ll be able to understand how important having a private pension is and make informed decisions.

How much should you save into your pension pot?

If you already have a pension, the exact amount to save for it depends on your unique situation and disposable income.

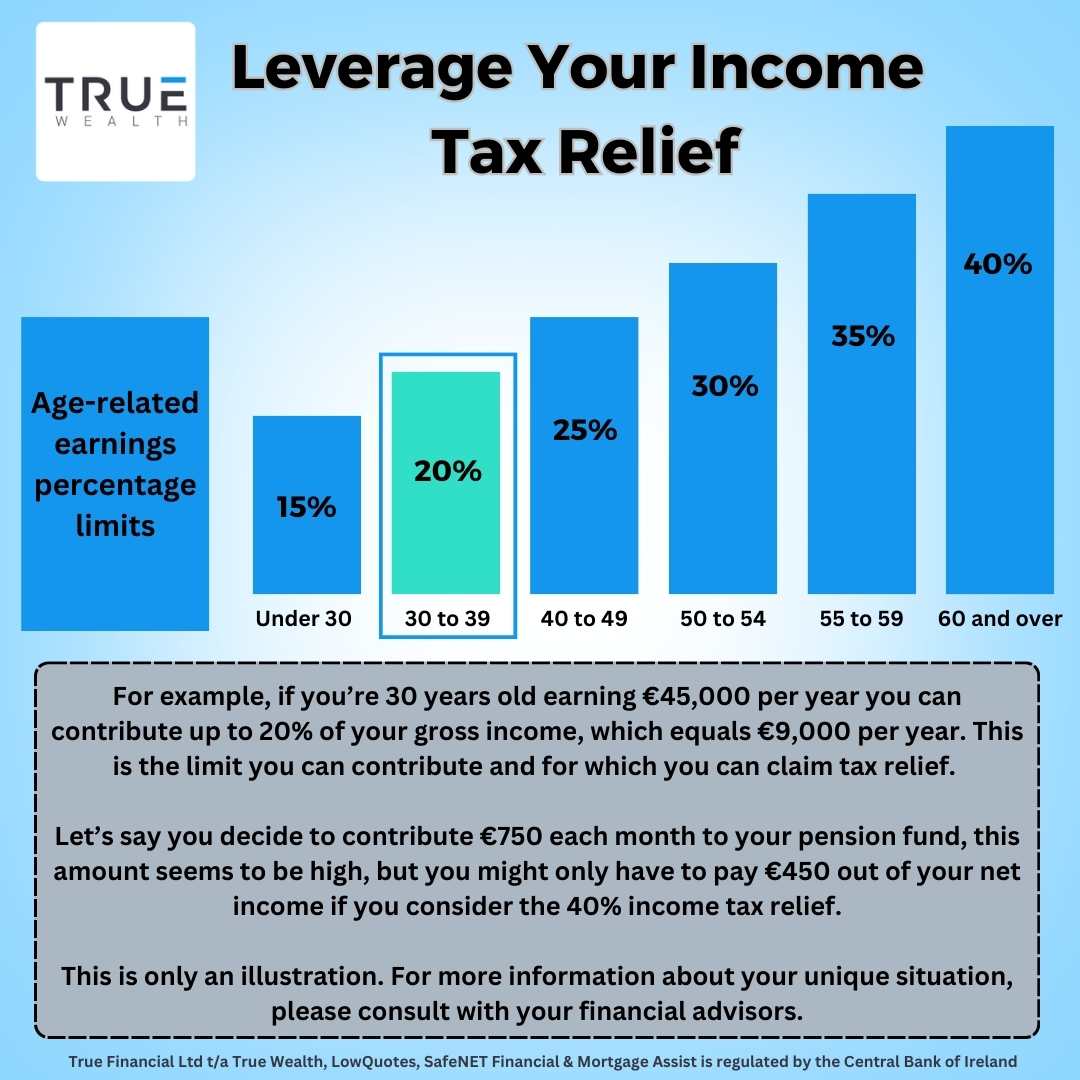

If you’re 30 years old, you can set aside up to 20% of your income for your pension and claim full tax relief. While this might seem like a lot to some, tax relief effectively reduces that 20% of your income contribution by 40/20%. This is a significant incentive to contribute into your pension.

For instance, you’re earning €45,000 per year and decide to contribute €750 each month to your pension fund. This amount seems to be high, but you might only have to pay €450 out of your net income if you consider the 40% income tax relief.

Get a Retirement and Pension Planning Quote

Steps to planning for your retirement in your 30s

1. Define your Retirement Goals

Defining retirement goals in your 30s is a crucial step to ensure you’re on the right path to a financially secure future. Consider these factors to help you assess your goals:

Visualise Your Ideal Retirement Lifestyle

Begin by picturing what you want your retirement to look like. Think about where you want to live, the activities you want to engage in, and the kind of lifestyle you desire. Consider factors like travel, hobbies, and time with family.

Set a Retirement Age

Decide on the age at which you want to retire. Your ideal retirement age can influence the amount of savings you’ll need and the time you have to achieve your goals.

Estimate Future Expenses

Project your future expenses by considering your current spending habits and how they might change in retirement. Account for essential costs like housing, healthcare, and daily living, as well as discretionary spending for leisure activities.

Don’t forget to factor in any potential adjustments for reduced expenses once your children have left home, which can significantly impact your financial planning.

Determine Your Desired Income

Calculate the income you’ll need in retirement to maintain your desired lifestyle. This should cover both essential and discretionary expenses.

Discuss this with us, and we’ll help you determine your required income in retirement as well as the best way to achieve your retirement goals.

2. Create a financial plan

Financial planning is the comprehensive process of managing your finances to achieve your financial goals and objectives.

It involves assessing your current financial situation, setting specific goals, and creating a plan to reach those goals.

We can develop a detailed financial plan that outlines how you will achieve your retirement goals. This plan should include income, outgoings, budget, savings goals, protection and investment strategies.

For a deeper understanding of why financial planning is essential in Ireland, we encourage you to explore our article and gain the knowledge needed to make well-informed choices.

3. Create a Realistic Budget

Creating a budget is a crucial element of your financial strategy. Pinpoint areas where you can trim unnecessary expenses and redirect those savings towards your retirement fund.

Our free personal budget planner is a valuable resource for those looking to manage their finances effectively.

By creating a monthly budget and consistently tracking your earnings, expenses, savings, and investments, you can strengthen your financial outlook and make informed decisions about where to allocate your money.

Get a Retirement and Pension Planning Quote

4. Take Advantage of Time and Tax limit

In your 30s, you have two significant advantages when it comes to saving for retirement that people later in their careers don’t: time and a lower tax limit.

Thanks to the power of compound interest, starting your retirement savings in your 30s allows you to contribute a smaller amount each month compared to starting in your 40s or 50s while still potentially ending up with the same sum at retirement.

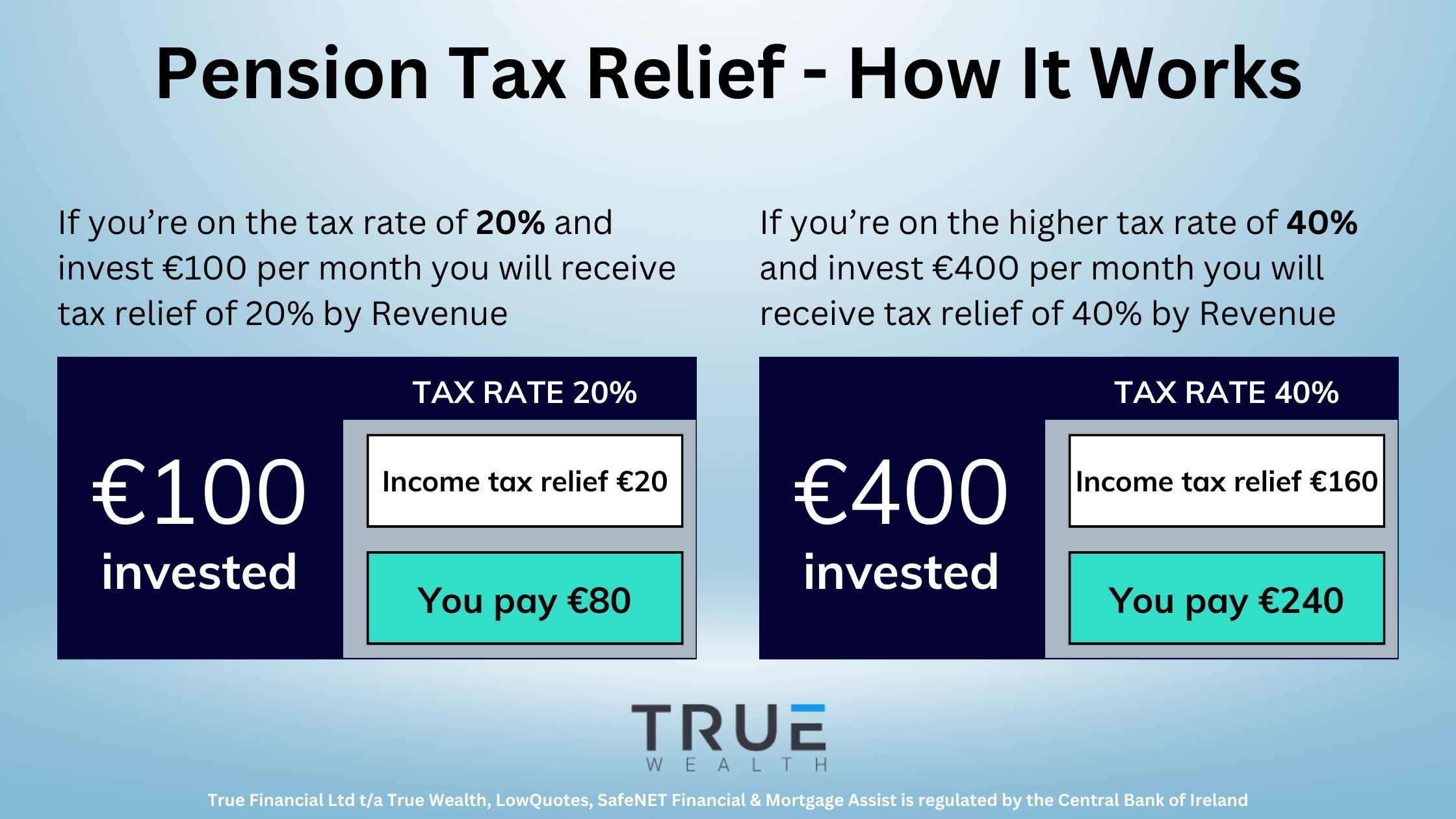

Here’s how pension tax relief works.

The exact tax benefits and rules can vary, so it’s advisable to consult with one of our financial advisors at True Wealth.

5. Leverage employer contributions

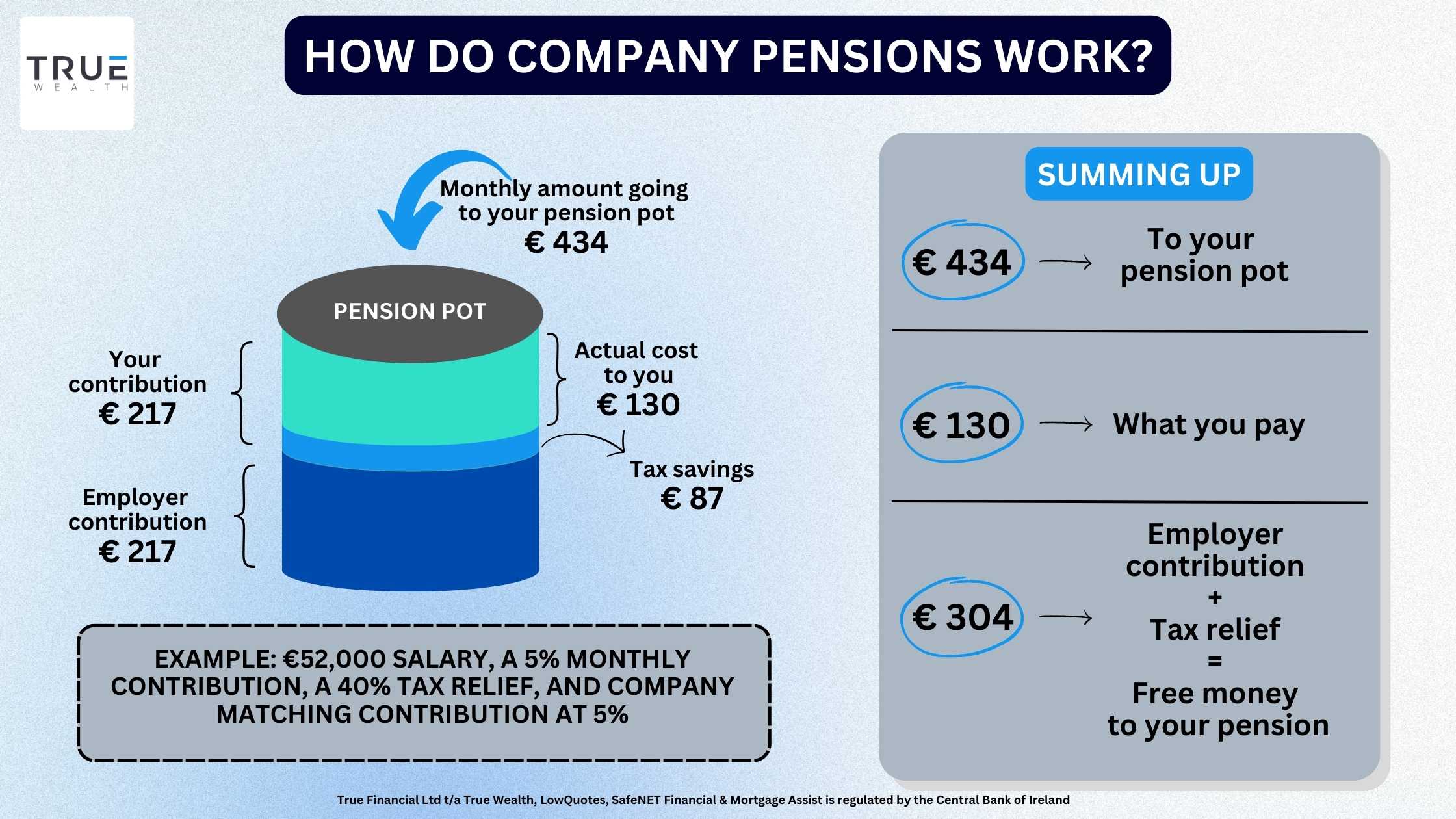

If your employer provides a pension plan with matching contributions, make sure to maximise this opportunity. Employer contributions can substantially boost your retirement savings.

This essentially provides free money for your retirement fund.

Example:

Consider this scenario where you’re employed and enrolled in a company pension plan.

Your annual salary is €52,000, and you contribute 5% of your salary monthly. The company matches your contribution at 5%.

Furthermore, your income places you in the 40% tax bracket.

Both you and your employer contribute €217 each, making a total of €434.

What’s essential to understand here is that, due to the tax relief, your actual cost is only €130. This means you can boost your pension savings while spending less, all thanks to the tax relief advantage.

6. Diversify investments

Diversify your investments across various asset classes, such as stocks, bonds, and real estate. This can help manage risk and potentially increase your returns over time.

Regularly review your portfolio to maintain your desired asset mix. You can get professional guidance from our financial advisors at True Wealth.

7. Seek Professional Advice

Working with our financial advisors at True Wealth can provide you with personalised guidance, ensuring that your retirement savings strategy matches your specific financial situation and retirement goals.

Get a Retirement and Pension Planning Quote

What is the Retirement Planning Process with True Wealth?

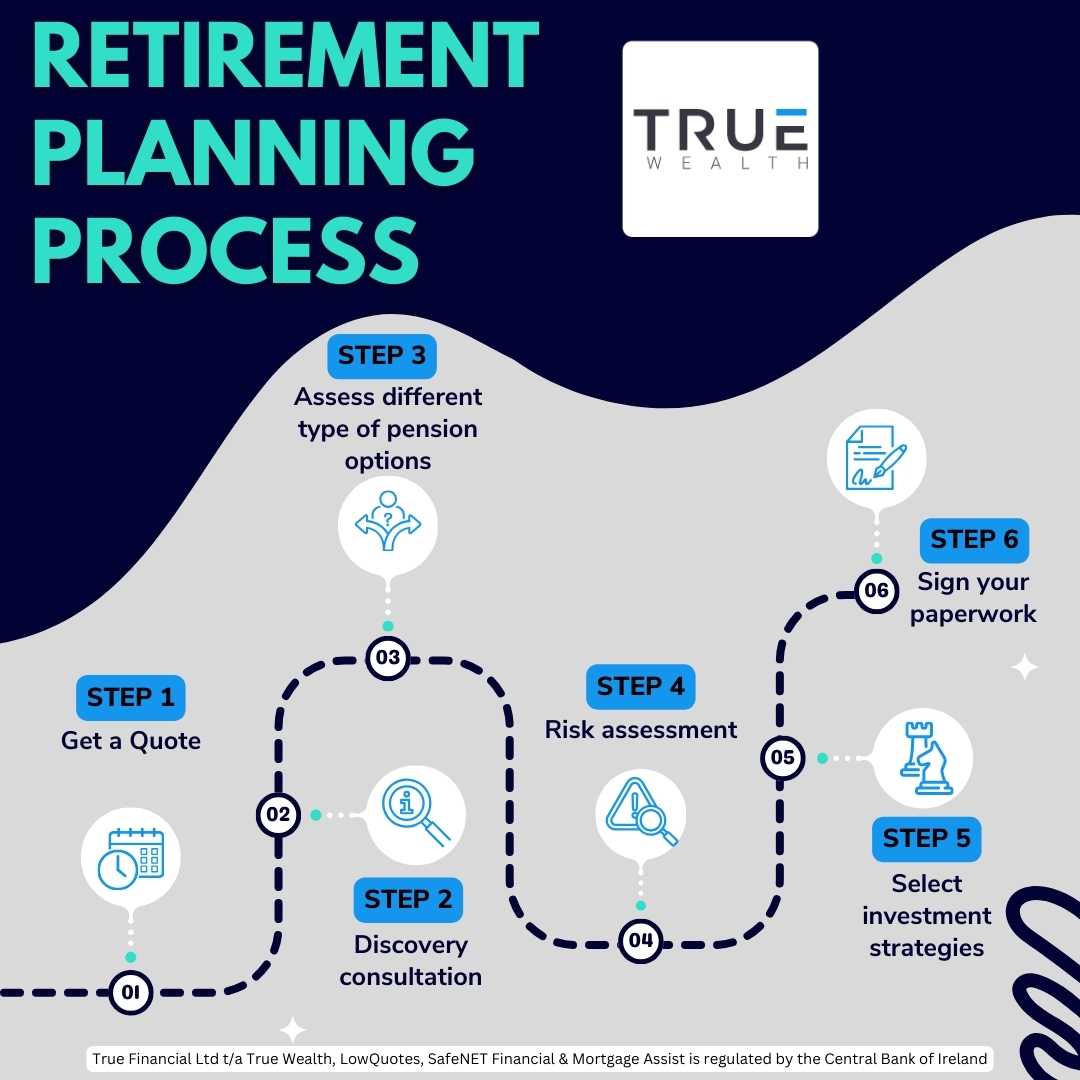

At True Wealth, we understand the importance of effective retirement planning and take pride in guiding our clients through each step of the process.

From the initial consultation to signing the paperwork, our dedicated team of financial advisors is with you every step of the way.

1. Get a quote

The first step in your Retirement Planning journey begins with getting a quote.

You will be asked some quick questions which will help us to pair you with a financial advisor to suit your unique situation.

2. Discovery consultation

During our discovery consultation, we provide you with a quote, and you’ll have the chance to have a one-on-one conversation with your dedicated financial advisor.

Your advisor will invest the time to grasp your unique situation and expectations, setting a solid groundwork for your retirement strategy.

Crafting a custom retirement plan involves a comprehensive fact-finding process. This entails collecting data about your current financial position, your comfort level with risk, your preferred investment options, and the timeline for your retirement.

This step is pivotal in evaluating the appropriateness of various pension options.

3. Assess different types of pension options

Our team will present you with a range of pension options tailored to your specific needs.

We will explain the advantages and disadvantages of each, ensuring you have a clear understanding of your choices.

This comprehensive assessment helps you make an informed decision about your pension plan.

5. Risk Assessment

Understanding your risk tolerance is fundamental to the pension process.

We will work with you to assess your comfort level with different levels of risk.

This information will guide the development of an investment strategy that aligns with your preferences and goals.

6. Select investment strategies

Based on the risk assessment and your long-term objectives, we will recommend investment strategies that maximise your retirement savings.

Whether you prefer a conservative approach, an aggressive strategy, or something in between, our goal is to create a diversified investment portfolio that suits your needs.

7. Sign your paperwork

Once you are satisfied with your retirement plan and investment strategy, it’s time to sign the necessary paperwork to put your retirement plan in action.

Our team will walk you through all documentation, ensuring that you understand each aspect of your pension arrangement.

Your Retirement in Your 30s with True Wealth

True Wealth understands that retirement planning is not one-size-fits-all.

We work closely with you to develop a personalised strategy that aligns with your unique financial situation, lifestyle, and retirement goals.

This tailored approach ensures that your plan is precisely designed to meet your expectations.

Seeking professional advice from True Wealth is an investment in your future. With our expertise, you can navigate the complexities of retirement planning in Ireland, make informed financial decisions, and secure a comfortable retirement that aligns with your dreams and aspirations.

Don’t limit your retirement to the State pension; partner with True Wealth for a well-structured and tailored retirement plan.

We are also experts in personal and business protection, savings and investments, pension tracing, personal and business financial planning, mortgages, and wealth extraction.

Get a Retirement and Pension Planning Quote

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down and up.

Warning: If you invest in this product, you will not have any access to your money until you retire.

Warning: If you invest in this product, you may lose some or all of your investment.

Warning: This product may be affected by changes in currency exchange rates.

Retirement Planning in Your 20s