Have Extra Funds? Boost Pension, Property Investment, or Both?

Table of Contents

If you’ve recently come into a lump sum and are looking to strengthen your retirement strategy, there are a few popular options in Ireland worth considering. You might consider buying an investment property, which can generate rental income and potential capital appreciation over time.

Another effective choice is making an Additional Voluntary Contribution (AVC) to your pension, which can enhance your retirement savings while offering tax relief benefits. Alternatively, consider purchasing property through your pension, combining real estate investment with the tax advantages of a pension fund.

These approaches offer growth potential, but which is better suited for your financial future? Let’s break down the advantages of both to help you make an informed decision.

Making an AVC to Your Pension

What is an AVC?

An AVC is an Additional Voluntary Contribution that you can make to your pension fund, boosting its value over time. It’s a tax-efficient way to increase your retirement savings, especially if you’re already contributing to an employer pension scheme or a personal pension.

Benefits of an Additional Voluntary Contribution

The returns from making an AVC depend on how your pension is invested, but typically, pension funds have the potential to grow significantly over time.

With the power of compound interest, even small contributions today can result in substantial retirement savings by the time you reach pension age.

Tax Benefits

AVCs offer immediate tax relief, which can be particularly beneficial if you’re in a higher tax bracket. You can receive up to 40% tax relief on AVCs if you’re in the higher tax bracket, meaning for every €100 contributed, it effectively costs you just €60.

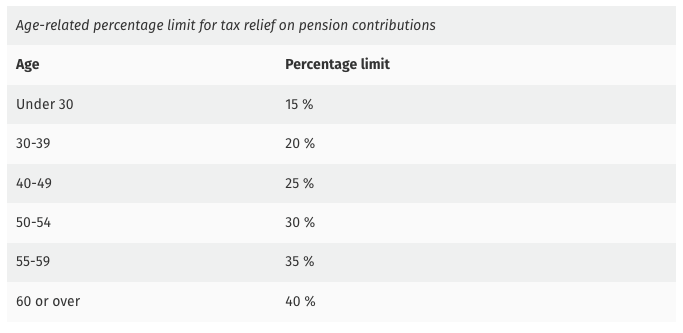

Tax relief on pension contributions is available up to certain limits, depending on your age. However, the maximum earnings you can apply these percentages to is capped at €115,000 per year for tax relief purposes.

Pension Fund Growth

Pension fund growth can be potentially very rewarding, but returns will vary depending on several factors. Market trends, the level of risk in the chosen fund, and the investment period all play key roles in performance. Higher-risk funds may offer greater returns but come with increased volatility, while lower-risk options tend to grow more steadily.

Over the long term, pension funds generally perform better as they benefit from market recoveries, economic growth, and compound interest. Therefore, staying invested for the long haul can maximise the potential for solid returns despite short-term fluctuations.

Fund Prices for Pension / Gross of Tax Funds for 29/10/2024

Source: https://www.zurich.ie/funds/fund-price-calculator

The table above shows different multi-asset funds with different risk ratings and annual performance over 1, 3, 5, and 10 years.

For example, the Prisma 3 fund has a 3-year growth rate of 8.14% and a 5-year growth rate of 20.61%, making it a moderate-risk option for investors. In contrast, Prisma 5 shows higher growth rates, such as 24.98% over 1 year and 70.04% over 5 years, but comes with a higher risk rating.

Source: https://www.zurichlife.ie/funds/fund-performance-chart

The graph above shows a fund performance chart that illustrates percentage growth over time for Prisma 3, Prisma 4, and Prisma 5 from 2015 to 2024. The graph highlights that Prisma 5 significantly outperformed the others, with growth reaching nearly 175% by 2024, while Prisma 3 remained lower at approximately 50-60% over the same period.

Making an AVC allows you to benefit from potential fund growth. For instance, if you had invested in the Prisma 5 fund, you could have seen a growth of over 170% in just 5 years. On the other hand, more conservative options like Prisma 3, with a growth rate of 20.61% over 5 years, offer steadier returns.

This highlights the importance of choosing a fund that aligns with your risk tolerance and long-term goals. Even with moderate contributions, the potential for compound growth can significantly boost your retirement savings.

When considering AVCs as part of your pension plan, it’s essential to keep in mind that all investments carry some level of risk. The value of your contributions can fluctuate, meaning your investment can go down as well as up. The returns you achieve will depend on both the risk level of the fund you choose and the natural ups and downs of the market.

When is an AVC a Good Option?

- If you want tax-efficient savings.

- If you prefer the simplicity of growing your retirement funds without the hassles of property management.

- If you’re looking for long-term growth without being tied to a single asset like property.

- If you want access to cash lump sum at retirement – property needs to be sold to make use of full value.

Get a Retirement and Pension Planning Quote

Buying an Investment Property

Why Invest in Property?

Property has long been seen as a solid investment, especially in Ireland, where demand for rental properties remains high. Purchasing an investment property can provide a dual benefit: generating rental income and potentially appreciating in value over time. For many investors, property offers a tangible asset that could serve as a valuable part of a long-term financial plan.

Rental yield, the annual return from renting out a property, is a key metric for property investors. Higher yields mean better returns.

In Ireland, rental yields are especially strong, making it one of the best places to invest in property. High demand for rentals and limited housing supply help create great opportunities for investors looking for steady income and property value growth.

Potential Returns from Investment Property

The potential return from property investment can come from two main sources: rental income and capital appreciation. However, it’s important to remember that the property market can be unpredictable, and your returns depend on several factors.

Rental Income

If you make a wise investment, the property could provide a steady stream of rental income, which could support your retirement or supplement your income in the long run. In Ireland’s strong rental market, demand remains high, especially in urban areas.

It’s important to be aware that when you own a rental property, any income you earn from rent is subject to Income Tax, PRSI, and USC. Additionally, if you sell the property for a profit, you’ll have to pay Capital Gains Tax (CGT), which is currently 33% in Ireland.

Property Value Growth

Over time, property values can be appreciated, potentially giving you a significant profit if you decide to sell later.

Property values in Ireland have experienced significant long-term growth. According to the Central Statistics Office (CSO), property prices nationally have surged by 141.2% since their lowest point in early 2013. Dublin residential prices have climbed by 140% from their February 2012 low, while prices in the rest of Ireland have seen an even higher increase of 150.6% since their trough in May 2013.

Source: Residential Property Price Index January 2024

The national Residential Property Price Index (RPPI) saw an 8.6% increase in the 12 months leading up to June 2024. Dublin experienced slightly higher growth, with prices rising by 9.3%, while property prices outside Dublin grew by 8.2%. This steady increase reflects the ongoing demand for residential properties across Ireland.

Mortgage Leverage

With a mortgage, you can buy a property that’s worth more than your initial cash savings. In Ireland, lenders typically let you borrow 70-80% of the property’s value, meaning you only need to put down 20-30% as a deposit. This way, you can invest in a larger property, increasing the potential for bigger returns as its value grows over time.

The Risks of Property Investment

While property has potential, it comes with risks that can’t be ignored:

Market Fluctuations: Property prices can go down as well as up, and there’s no guarantee of capital appreciation.

Management Costs: Owning a rental property comes with ongoing costs such as maintenance, property taxes, and potential void periods where the property isn’t rented out.

Illiquidity: Property is not a liquid asset. If you need to access your funds quickly, selling a property can take time and may not always fetch the price you expect.

When is Buying Property a Good Option?

- If you’re comfortable with the risks and have experience managing property.

- If you want passive rental income that could supplement your pension during retirement.

- If you’re looking for a tangible asset that could appreciate in value.

Get a Savings & Investments Quote

Buying Property Using Your Pension Funds

For those who are more inclined towards property investment but also see the value in pensions, there is another option: buying property through your pension fund.

In Ireland, certain pension funds, particularly PRSA, allow you to purchase property as part of your retirement plan.

These property purchases are typically structured through a unit trust, with a separate sub-fund created for each property. This setup provides added protection for your other pension assets because if you borrow to purchase the property, the bank can only claim against the sub-fund, not the entire pension.

Additionally, if VAT applies to the property purchase, the sub-fund can be registered for VAT without needing to register the whole pension fund.

It’s also essential to understand that Revenue has specific rules that govern property investments within pensions, so compliance is key when pursuing this strategy.

How Does It Work?

You can use your pension contributions to purchase commercial or residential property. The rental income earned from this property goes directly back into your pension fund, helping it grow.

Tax-Free Growth

One of the significant advantages of purchasing property with pension funds is the tax efficiency. Any rental income or capital gains generated from the property remain within the pension fund and are not subject to tax.

When you own a property outside of a pension and rent it out, any rental income you earn is subject to Income Tax, PRSI, and USC. Additionally, if you sell the property and make a profit, you’ll have to pay Capital Gains Tax (CGT), which is currently 33% in Ireland.

However, if you purchase a property using your pension funds, the rental income and any profit from selling the property stay within the pension fund and are not taxed at that time. This means you avoid paying income tax on the rental earnings and CGT on the sale, allowing the funds to grow tax-free. This difference can significantly boost the growth of your pension compared to owning a property outside of the pension.

Liquidity Requirements

You’ll need to ensure your pension fund has enough liquidity to cover expenses such as maintenance and management fees.

Management Considerations

Although you’re not managing the property personally, you’ll need to appoint a property manager, and the pension fund will handle the financial side.

Post-Retirement Income with an ARF

Upon retirement, the property can be transferred directly into an Approved Retirement Fund (ARF), allowing it to continue generating income after retirement. The rental income can cover withdrawals from the fund, helping to preserve the fund’s capital and reduce the risk of running out of money during retirement.

When is This a Good Option?

- If you’re keen on property investment but want to keep the benefits within a tax-efficient pension wrapper.

- If you have experience with property and understand the management and liquidity requirements.

- If you’re willing to lock up the investment in your pension fund until retirement age.

Get a Property Through Your Pension Quote

Which Option Is Right for You?

When deciding between making an AVC or buying a property for retirement, the decision depends on your risk tolerance, investment preferences, and retirement goals.

- Choose AVC if you prefer a straightforward, tax-efficient way to grow your retirement savings with the potential for long-term investment returns.

- Choose Property Investment if you’re willing to manage the responsibilities and risks of owning property but want the chance for rental income and property appreciation.

- Choose Property Through Pension if you want the benefits of both: property investment and pension tax advantages.

- Before making any decision, it’s advisable to consult with a financial advisor who can assess your personal situation and guide you through the best option for securing your retirement.

Talk to our financial advisors at True Wealth

Talk to one of our financial advisors if you’ve received a lump sum and aren’t sure what to do but want to secure your financial future and your family’s.

We understand that every situation is unique, and our financial advisors can help you find the best options based on your specific circumstances. Whether you’re considering investing, making pension contributions, or planning for your long-term goals, we can guide you towards a solution that ensures peace of mind for the future.

We are also experts in savings and investments, pension tracing, personal and business financial planning, mortgages, protection, wealth management and extraction and more.

Get a Financial Planning Quote

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down and up.

Warning: If you invest in this product, you will not have any access to your money until you retire.

Warning: If you invest in this product, you may lose some or all of your investment.

Warning: This product may be affected by changes in currency exchange rates.

How Cancer Could Impact Your Business and Financial Future